University spin-outs turn UK research into real-world innovation. They create jobs, strengthen productivity, and are an important driver of economic growth from our universities.

If we can better understand the ecosystem through high quality and accessible data, we can drive forward improvements and understand what further support is needed.

Building on the university spin-out register

In June 2025, the Higher Education Statistics Agency (HESA) published the first university spin-out register, developed in partnership with Research England and the Policy Evidence Unit for University Commercialisation and Innovation (UCI).

The register’s publication represents a first step in providing richer insights into the scale, characteristics and trajectory of spin-outs across the UK.

Building on this foundation, the indicators in this ‘data digest’ present richer insights into the health of the UK’s university spin-out ecosystem and its role in driving forward economic growth.

This report unlocks the fuller potential of the university spin-out register, using it as a basis from which to identify and extract fuller company information from other datasets to provide deeper and readily accessible analysis for users.

The data and insights presented are also enriched with diverse examples of spin-out companies from our universities.

This data digest is an output of Research England’s national knowledge exchange metrics programme, and has been developed in partnership with UCI in their role as national knowledge exchange metrics advisers to Research England.

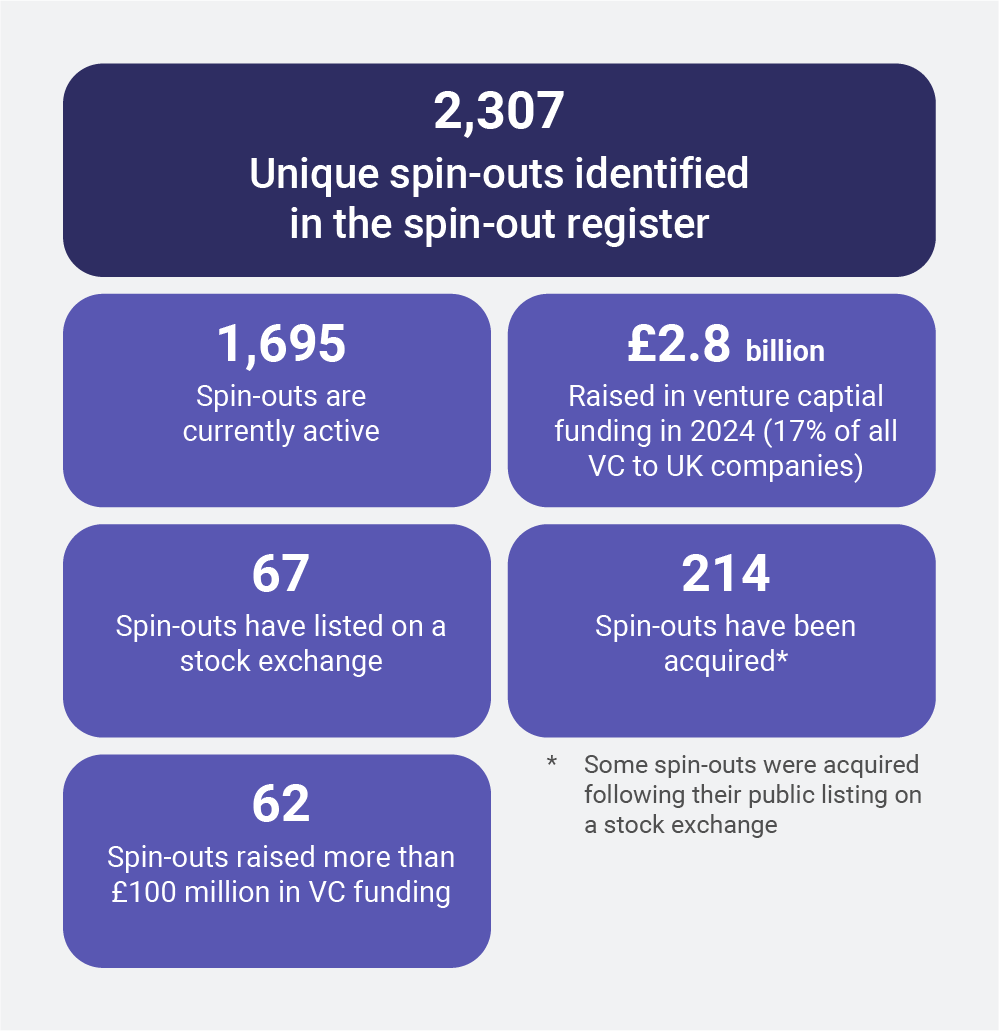

Current breakdown of spin-outs in the register

In the latest update to the spin-out register in September 2025, 2,307 unique spin-outs were identified, demonstrating the scale of innovation emerging from UK universities.

Analysis of these 2,307 spin-outs is presented in Figure 1 and reveals the following:

- 1,695 active spin-outs

- £2.9 billion raised in venture capital funding in 2024 – 17% of all venture capital funding to UK companies

- 67 spin-outs have listed on a stock exchange

- 214 spin-outs have been acquired (some spin-outs were acquired following their public listing on a stock exchange)

- 62 spin-outs have each raised more than £100 million in venture capital funding

Figure 1: Infographic describing key information about the spin-outs in the register

Combining the spin-out register data with external sources unlocks greater detail on the trajectories of spin-out companies in the UK.

The data from the UCI Powering ideas to innovation report illustrates this approach by linking spin-out register data with information from Moody’s financial analysis platform FAME, Pitchbook and Companies House.

However note that the remaining analysis from this point onwards is based on an earlier cut of the spin-out register data in June 2025.

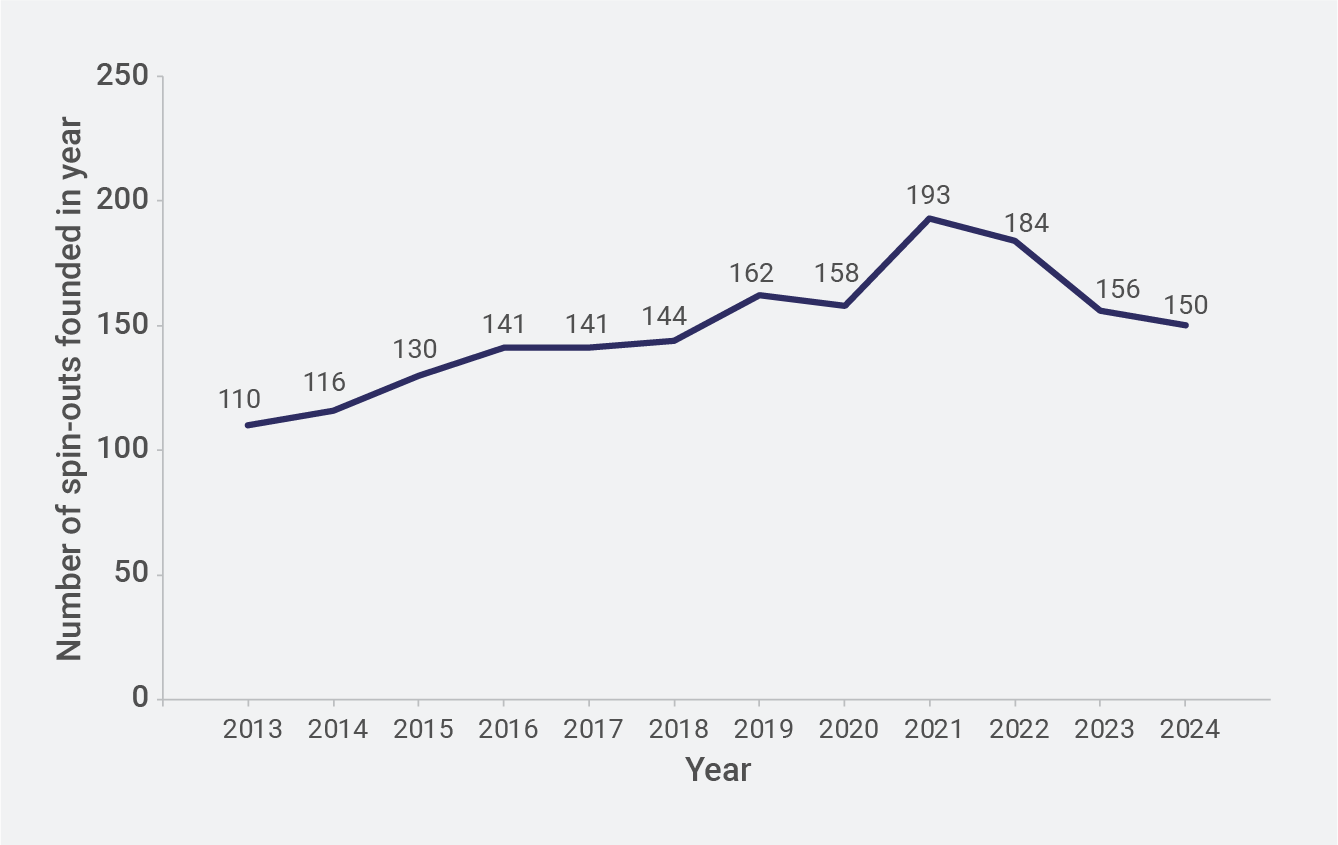

How the total number of spin-outs is changing

Figure 2 shows the annual number of new spin-outs created from UK universities. The trend shows an ongoing upward trajectory with a spike in activity prompted by the crisis of the COVID pandemic.

Figure 2: Annual production levels of unique UK spin-outs between September 2012 to August 2024

Note: The years represented in the graph refer to the Higher Education Business and Community Interaction Survey reporting period for that year and cover the period 1 August to 31 July. Spin-out foundation dates are supplied by UK higher education providers and published in the spin-out register.

We don’t consider the volume of spin-out companies produced to be an indicator in isolation of quality. Long-term trajectories or scale in activity can provide helpful contextual insights to understand changes in behaviours or external drivers that may go on to affect the likely success of these companies.

The increase in the number of spin-outs, shown in Figure 2, highlights the effective translation of research into commercial ventures, signalling a robust commercialisation pipeline in the UK.

The most recent years show early signs of stagnation and decline, which should be closely observed in future years.

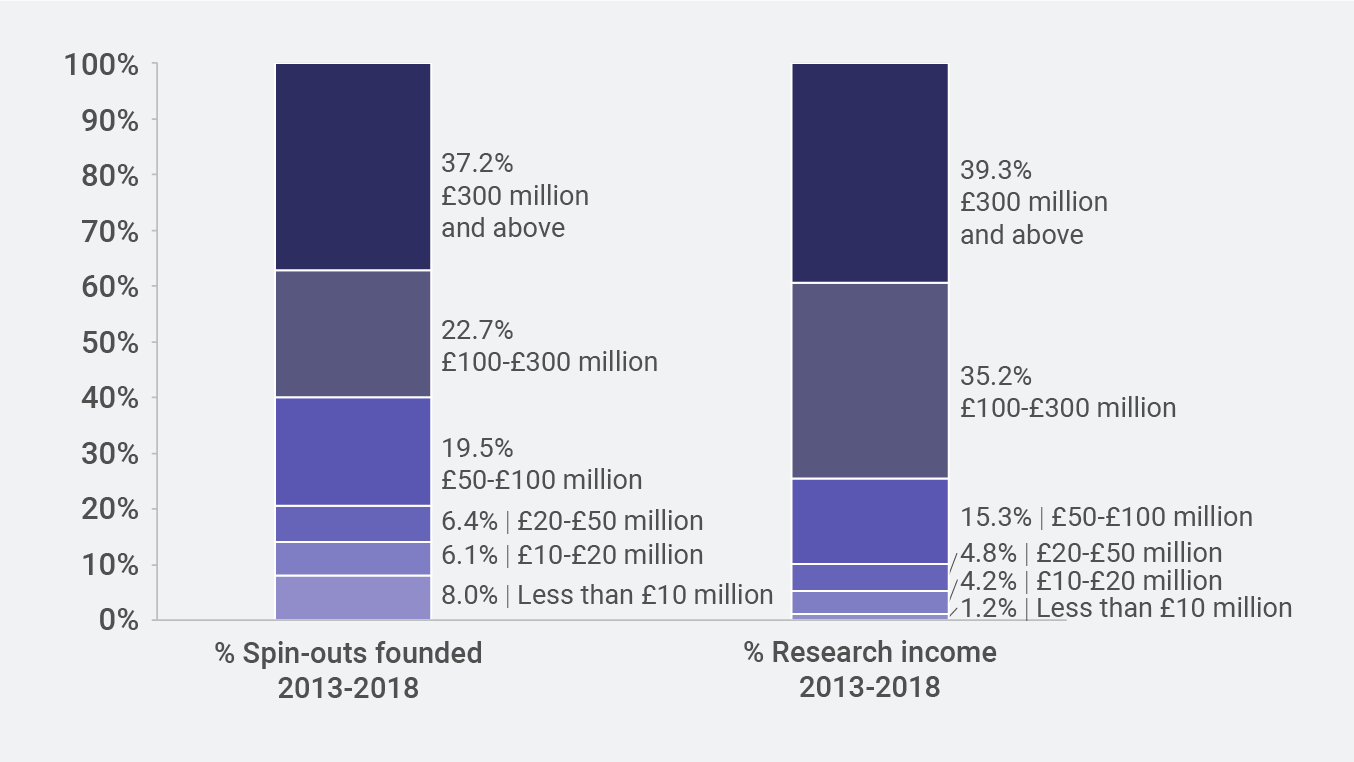

How spin-out production varies by type of higher education provider

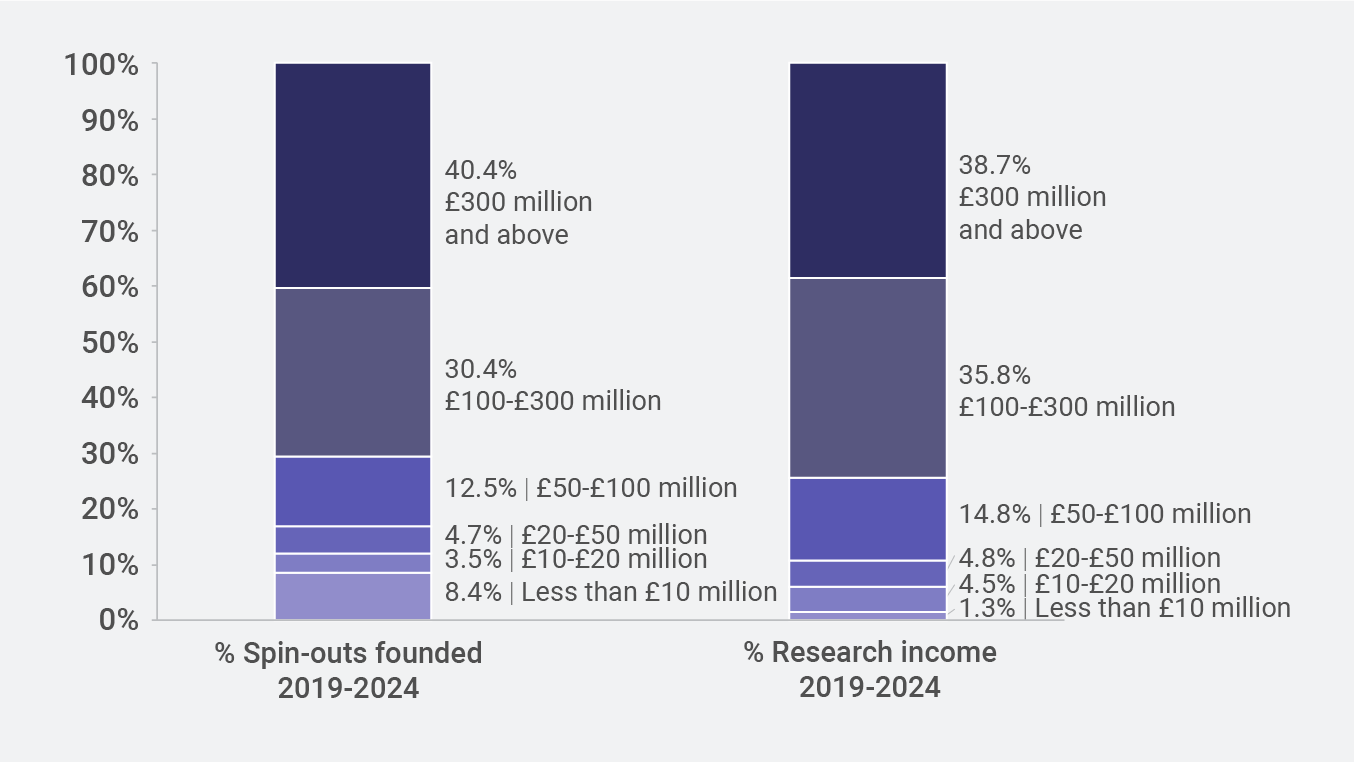

Figures 3a and 3b compare the share of spin-outs founded by higher education providers (HEPs) with their share of research income. The figures compare two different time periods, 2013 to 2018 and 2019 to 2024, segmented by research scale group. The research scale group is based on the average research income of HEPs between 2012 to 13 and 2023 to 24.

These figures use data from the spin-out register, combined with external data on university research income from HESA’s Finance Record, to highlight a clear correlation between an increased scale of an institution’s research base and increased spin-out production.

This integrated approach provides a richer picture of how research scale can play a key factor in spinning out.

Figure 3a: The distribution of spin-outs and research income during the periods 2013 to 2018 (HEBCI years) across groups of HEPs with different scales of research base

Figure 3b: The distribution of spin-outs and research income during the period 2019-2024 (HEBCI years) across groups of HEPs with different scales of research base

Universities are the bedrock of the UK’s spin-out ecosystem. The diversity of university strengths and specialisms across the country ensures a rich flow of ideas, expertise and innovation into commercial ventures and then into real-world impact.

Better understanding trends in the universities producing spin-out companies therefore provides important context on the health of contributions being made across the sector.

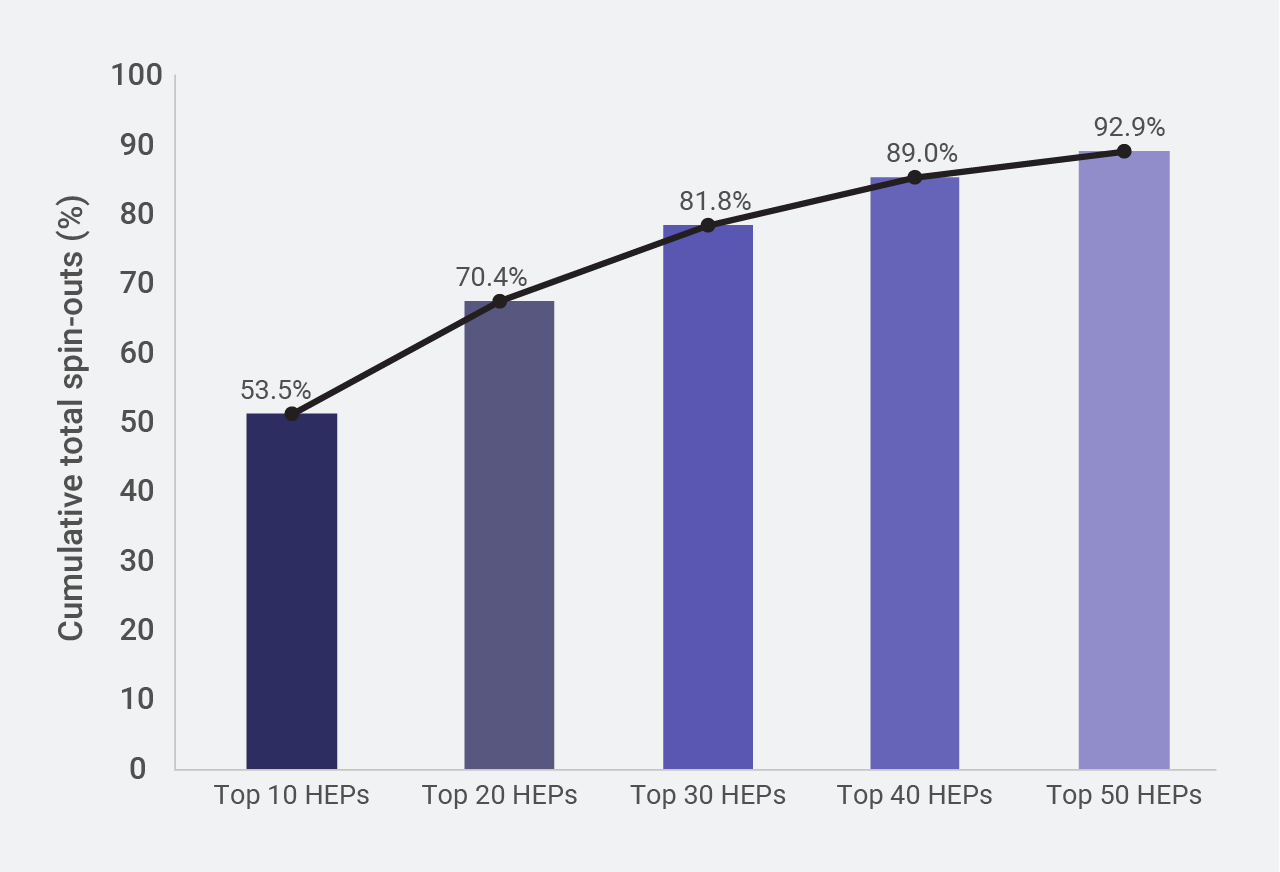

Figure 4 shows the cumulative total of spin-outs produced by percentage of the top HEPs for spin-out production. The figure illustrates the continued concentration of spin-out production to a relatively small number of institutions, primarily within the top 50 higher education providers for spin-out production.

This further demonstrates how investment in research and into UK universities fuels innovation, but also how critical significant research capacity is in building a spin-out pipeline.

Figure 4: The cumulative total of spin-outs produced across the groups of top 10, 20, 30, 40 and 50 HEPs for spin-out production

HEPs have been ranked by total numbers of spin-outs founded between 2013 and 2024.

How production of spin-outs varies across nations and regions of the UK

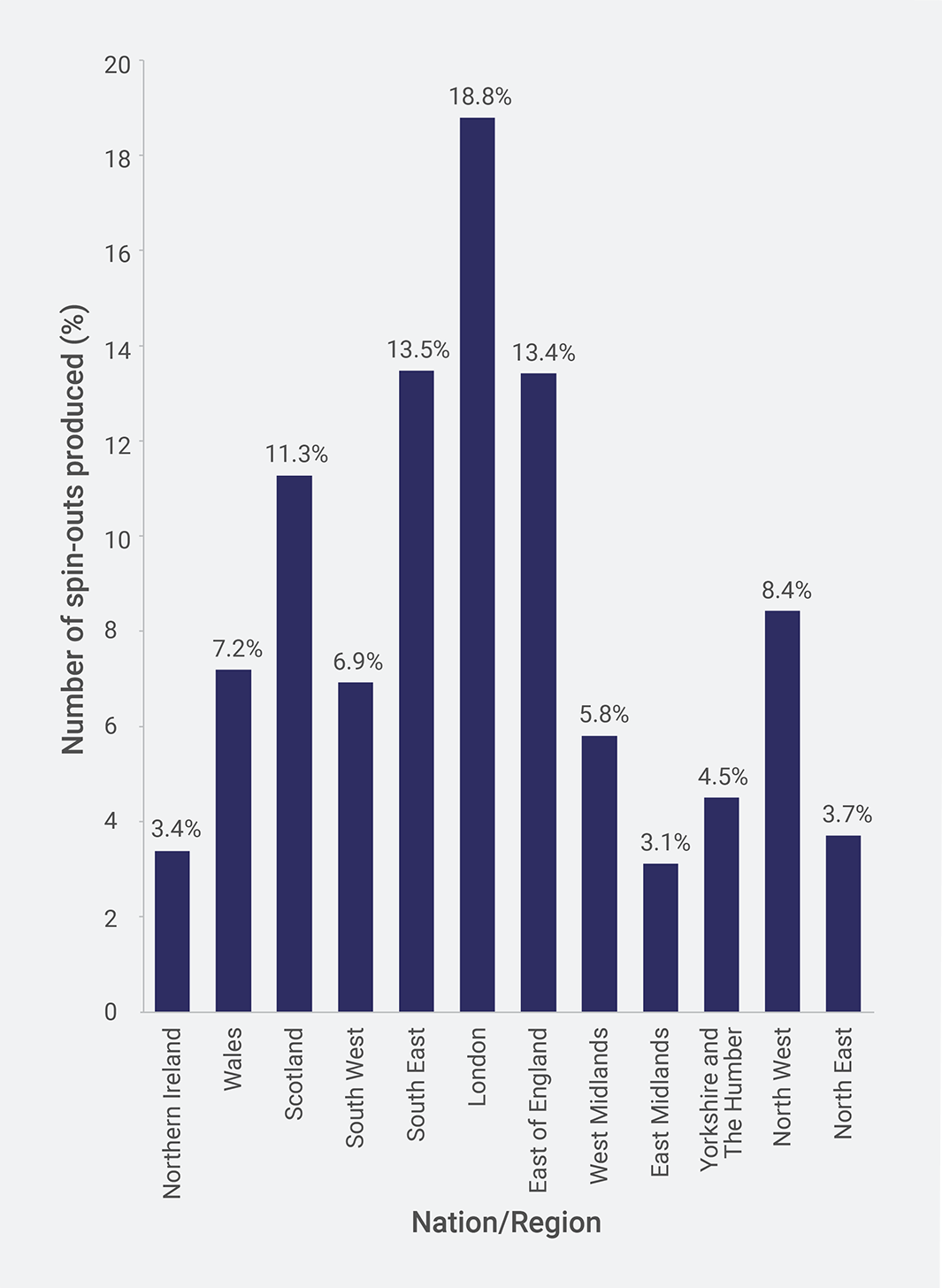

Understanding the regional distribution of spin-out production provides valuable insight into how innovation is spread across the UK.

Figure 5 draws on data from the spin-out register to demonstrate that the East of England, London and the South East account for the largest share of spin-out activity in England at 45%.

This concentration mirrors the presence of four of the UK’s largest research-intensive universities, in addition to these regions being home to over half of all English institutions in total.

The pattern again demonstrates the strong link between research intensity and spin-out generation, whilst also highlighting potential opportunity for further growth across other regions.

Figure 5: The share of spin-outs produced by HEPs in each of the UK’s nations and English regions

The dataset considers spin-outs founded between 2013 and 2024. Variation in spin-out production across nations and regions should be considered alongside the underlying research income received by the HEPs in these nations and regions. See Figure 8a for data on average annual research income.

Academic origins and industrial applications of UK spin-outs

This section examines the distribution of companies both emerging from different academic disciplines and operating in different industrial sectors. This is important context to the individual growth pathways distinct types of companies will likely take and how they may be contributing to differing parts of the economy.

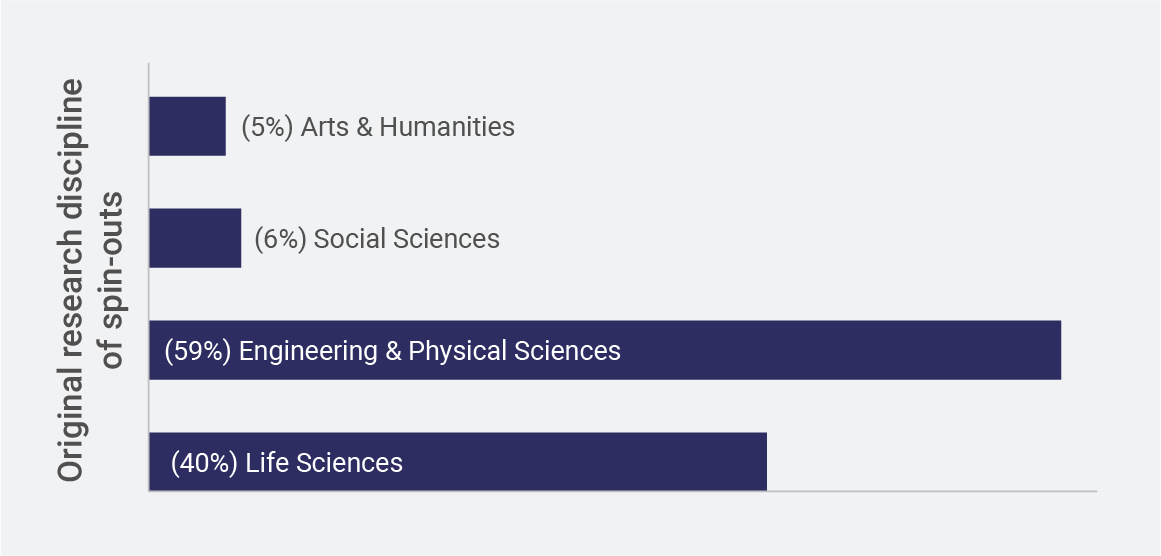

Figure 6a classifies spin-outs by their originating academic discipline. It shows that STEM fields are the majority source of new ventures, highlighting the strength of the UK’s STEM research base in producing commercialisable ideas and technologies.

Figure 6a: The originating disciplines of all UK spin-outs recorded in the spin-out register

Note: Disciplines are classified according to the Research Excellence Framework (REF). The REF classifies academic disciplines into four main panels:

- life sciences (panel A)

- engineering and physical sciences (panel B)

- social sciences (panel C)

- arts and humanities (panel D)

Some spin-outs are associated with multiple REF main panels.

Spin-outs often extend beyond their academic origins, applying knowledge and innovation to sectors that are not directly tied to their founding discipline.

Whilst the spin-out register captures the academic origins of the spin-outs, this data can be linked with external sources that include their industry and sector classifications.

The data from the UCI Powering Ideas to Innovation report demonstrates this approach by linking spin-out register data with Pitchbook data.

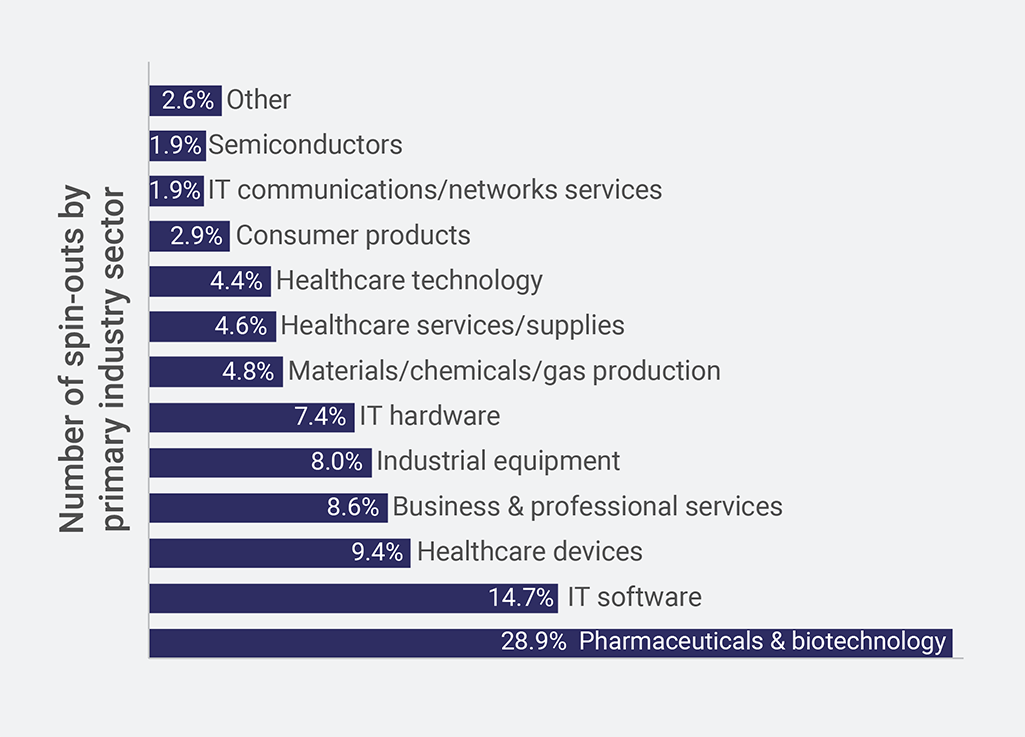

Figure 6b highlights the primary industry sectors of the spin-outs. It illustrates how founding academic disciplines research can translate into a diverse range of commercial applications, and the relative strengths on UK spin-outs in areas of national strategic importance including pharmaceuticals and biotechnologies, and advanced manufacturing.

Figure 6b: The sectoral composition of all UK spin-outs recorded in the spin-out register

Presenting this data highlights the existing strengths of the UK spin-out ecosystem but also reveals opportunities for growth and diversification.

Traditional sectoral classifications do not always capture the realities of today’s innovation landscape and emerging or more niche technologies.

It should be noted that approximately 60% of spin-outs that have originated from arts, humanities and social sciences backgrounds have unknown sectoral data.

A clear understanding of sectoral origins and market composition tells us where there are gaps in the sector which might be optimised. This can help shape targeted strategies for support to ensure spin-outs thrive across a diverse range of industries.

Case study A: Gravity Sketch

Founded in 2014 as a spin-out from the Royal College of Art, Gravity Sketch offers an immersive 3D design platform that uses virtual reality.

The design tool enables designers to create and manipulate models in a three-dimensional space. Gravity Sketch has since worked with notable customers such as Ford, Adidas and Reebok and have secured significant funding, including a $33 million Series A round in 2022.

This spin-out exemplifies how companies with arts and humanities origins can drive innovation across a diverse range of industries.

Case study B: YASA Motors

Founded in 2009 from Oxford University, YASA’s core technology is an innovative axial flux motor, which significantly enhances the performance, range and cost efficiency of electric vehicles.

After being acquired by the Mercedes-Benz group in 2021, the company invested £12 million in an upgrade to its factory in May 2025, followed by an investment of £26.8 million for a purpose-built HQ headquarters in Oxfordshire.

YASA supplies high-end sports car manufacturers, including Ferrari and Lamborghini.

It is a strong example of an innovative technology finding applications across multiple sectors, as YASA’s capabilities extend to the automotive, marine, defence, and aerospace sectors.

How types of investments have changed

Insights into the trends in accessing investment is important in understanding this often key driver of spin-out development, and indicator of long-term success for some types of companies and sectors.

Investment can provide the resources needed to scale ideas into impactful businesses and therefore increase their contributions to growth of the economy.

While some spin-outs may choose alternative routes to scale and grow, equity backed investment often provides spin-outs with the resources to accelerate innovation.

Linking the spin-out register data with investment data from external sources can help to identify which types of spin-outs attract funding at different stages and where gaps in support may exist.

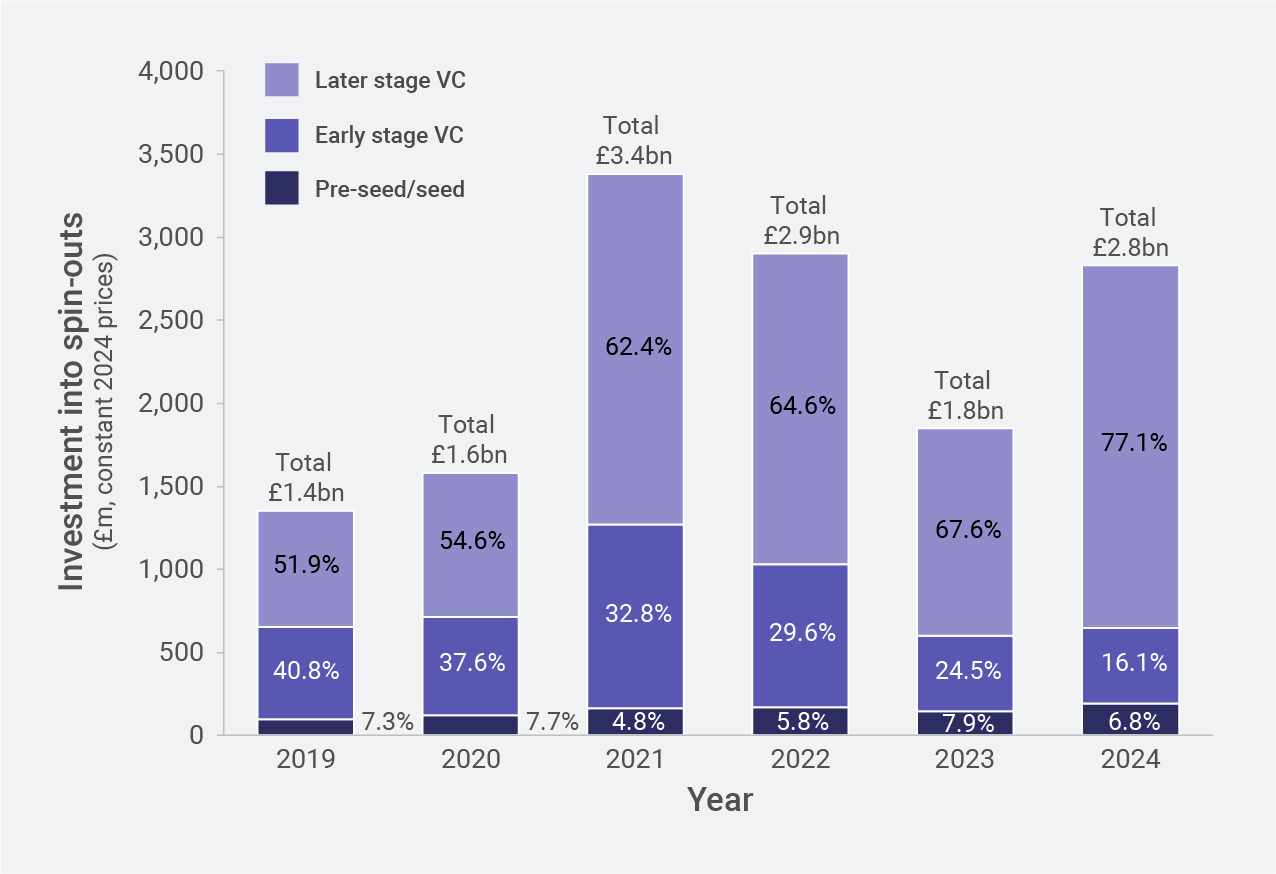

Figure 7 presents the evolving trends in pre-seed, seed, early stage venture capital (VC) and later stage VC investment as a percentage of total investment, across the period 2019 to 2024.

Overall venture capital investment has doubled since 2019. There has been a notable growth in the late-stage investments and steady growth in pre-seed and seed funding which may signal that many spin-outs are maturing and attracting significant backing.

However, the decline in early-stage investments highlights an area of potential concern for continued attention.

Figure 7: Pre-seed, seed, early stage VC and late stage VC investment into university spin-outs, listed in the spin-out register, between 2019 and 2024

Note the data presented uses constant 2024 prices.

How investments have been influenced by geography

Linking the spin-out register data with investment data from external sources, can also allow us to examine of regional disparities, not just in company formation, but also in the ability of these companies to scale and grow. The data from the UCI Powering Ideas to Innovation report showcases this.

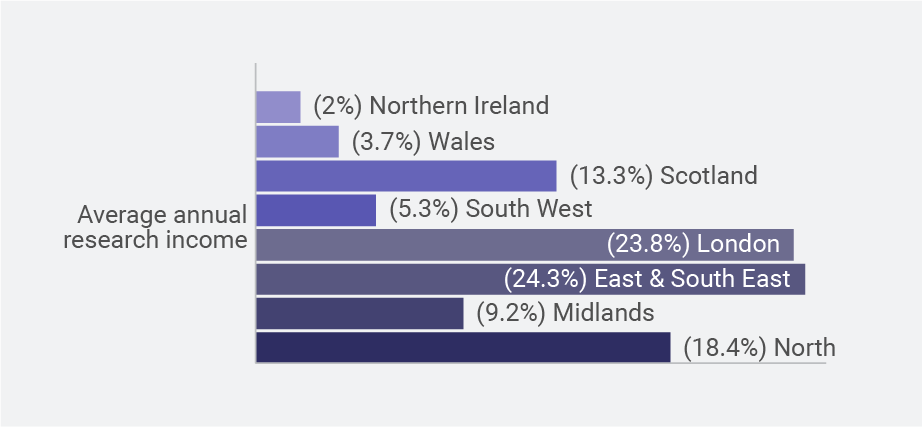

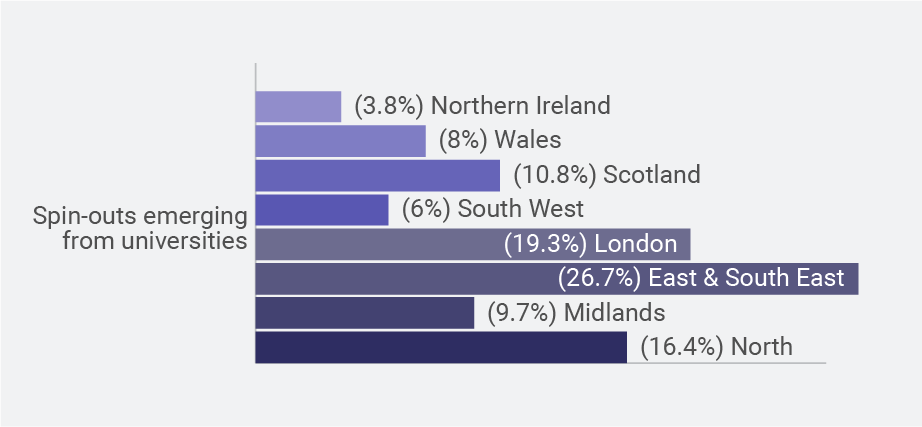

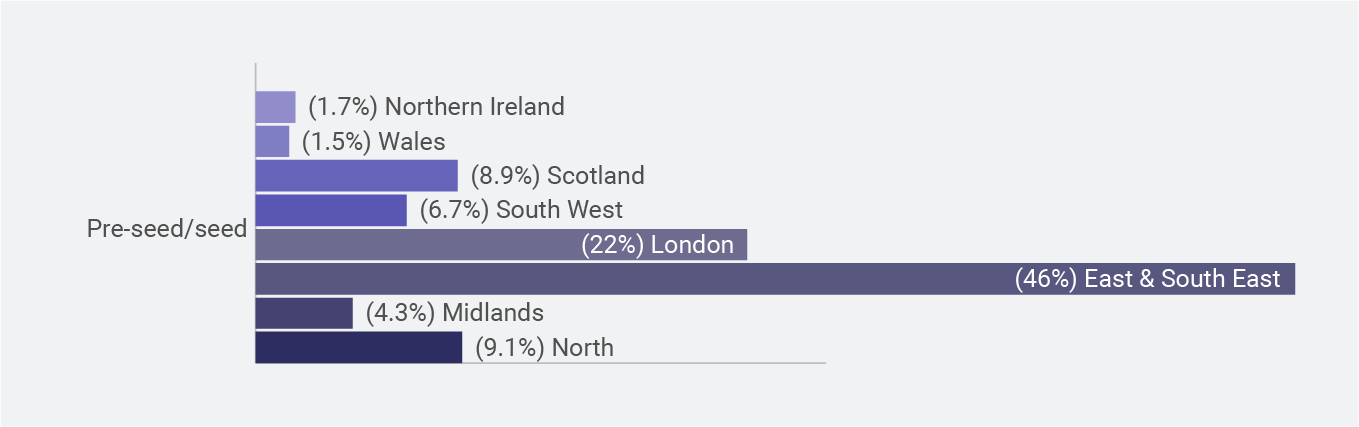

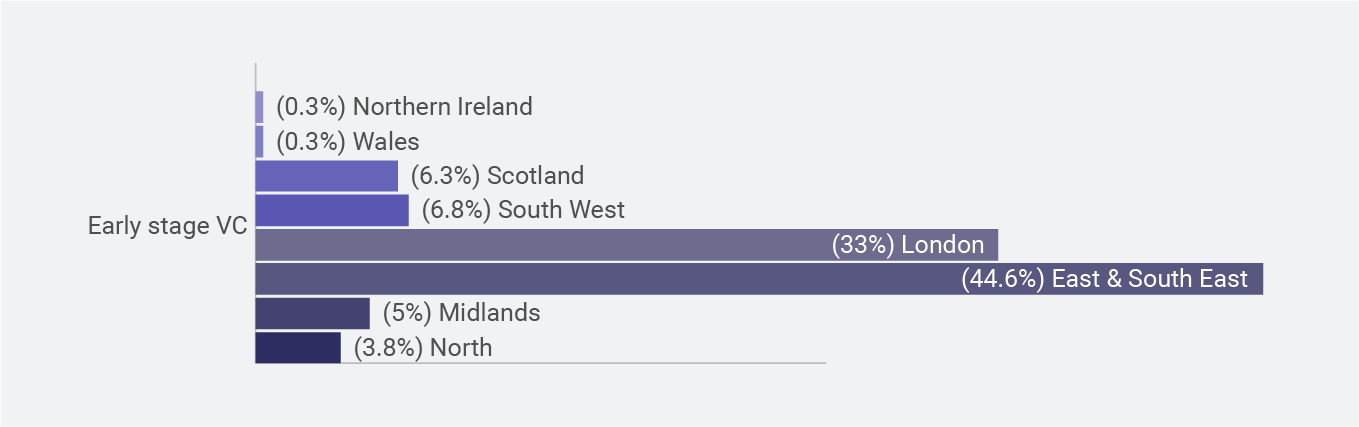

Figures 8a, 8b, 8c and 8d show the distribution of different stages of investment across the UK as a percentage. They demonstrate that, although the distribution of spin-out companies across the UK is broadly aligned to the scale of the underpinning research base, investment levels are more skewed towards institutions based in the ‘greater south east’ (London, South East, and the East of England).

Figure 8a: The average annual research income received by HEPs across the nations and regions of the UK

Figure 8b: The number of spin-outs emerging from HEPs across the nations and regions of the UK

Figure 8c: Pre-seed and seed investment across the nations and regions of the UK

Figure 8d: Early stage VC investment across the nations and regions of the UK

Case study C: Quantum Base

Quantum Base, a Lancaster University spin-out founded in 2013, has developed its core technology Q-ID, a unique digital identity technology that cannot be copied, cloned or faked. It is designed to combat counterfeiting and fraud and has a range of applications across sectors.

In 2025 Quantum Base floated on the London Stock Exchange, raising £4.8m through its Initial Public Offering and becoming Lancaster University’s first spin-out to achieve a public listing. This milestone highlights Lancaster University’s strong track record in cyber security research and attracting investment into the region’s economy.

Case study D: Ceryx Medical

Ceryx Medical, a spin-out from the universities of Bristol and Bath, is a medtech company that is developing innovative solutions for cardiac care. Ceryx Medical took part in Innovate UK’s ICURe programme and has since benefited from support through the SETsquared Scale-up Programme, a programme funded through Research England’s Connecting Capabilities Fund.

It has raised over £11m to date, including:

- an initial seed funding round of £575,000

- £3.8m in 2022 to accelerate the first in human trials

- a further £5m funding round in 2025

Ceryx Medical’s journey illustrates how the innovation ecosystem in the South West can help spin -out companies and successfully secure funding to scale.

Next steps for this data

Research England intends to build on the themes presented in this digest, to develop an interactive, publicly accessible dashboard.

This will enable open scrutiny of the data to enable users to get unique and diverse insights into the health of spin-out ecosystem.

Current priorities for the ongoing, and iterative development of such a dashboard will include understanding:

- the health of the university system in producing valuable spin-outs

- the effect of spin-outs on regions, industries and the UK economy

- the performance drivers for success

Data sources

Ulrichsen, T. C. and Miller, J. 2025. Powering Ideas to Innovation: The significance, structure and dynamics of the UK university spin-out ecosystem. Policy Evidence Unit for University Commercialisation and Innovation (UCI), University of Cambridge. Based on data published in the university spin-out register on 5th June 2025, Pitchbook, Moody’s FAME and Companies House.