Budget

At the 2025 Spending Review, the UK government announced record public R&D investment of £86 billion across the spending review (SR) period, covering the financial years 2026 to 2027 to 2029 to 2030. On 30 October 2025, the Department for Science, Innovation and Technology (DSIT) published more detail on its plans to allocate its £58.5 billion budget for the SR period. Including a new more agile model, and set out three research and development (R&D) priorities (‘buckets’) supporting:

- curiosity-driven, foundational research

- strategic government and societal priorities

- innovative companies

DSIT allocated £38.6 billion to UK Research and Innovation (UKRI), and as the UK’s largest public investor in research and innovation, UKRI will align with these buckets. This reflects UKRI’s vital role to ensure public money is invested to deliver outcomes for the nation through our mission to advance knowledge, improve lives and drive growth. UKRI will undertake fewer activities, delivered with greater focus, in order to generate the greatest impact to meet UKRI’s strategic objectives.

This marks the most significant change in how UKRI allocates funding and manages its budgets since the organisation was established. The new approach emphasises strategic, outcome-focused investment and dynamic budget management. The new model is underpinned by key principles: greater transparency in decision-making, clearer capital allocation, a stronger focus on growth, and a sharper alignment with societal and government priorities.

It also reaffirms the long-term benefits of curiosity-driven, foundational research, seeks better leverage by opening new opportunities for private sector investment, and prioritises outcomes over inputs. UKRI will design programmes and calls with the goal of improving efficiency for the research and innovation community. By adopting these principles, UKRI is better positioned to deliver on its mission and respond to emerging opportunities, ensuring that public investment in research and innovation (R&I) achieves maximum impact.

As a result of UKRI’s allocations, the overall level of funding available for universities, researchers and innovators throughout the spending review period increases. With universities receiving a large majority of UKRI funding, they are expected to be among the key beneficiaries of this growing investment.

This document provides a breakdown of UKRI’s allocations for financial year 2026 to 2027 to financial year 2029 to 2030.

The new outcome-focused approach to allocations, which includes a pivot to targeted programmes to deliver on government priorities, means that it is not possible to directly compare these allocations to previous budgets or explainers. This includes comparisons with historic sector or research council investment levels. As this new model is implemented, UKRI will engage with disciplines and sector bodies and will monitor performance and impacts, maintaining the flexibility to adjust or adapt investment plans through the spending review period.

A breakdown by research council is only possible for curiosity-driven research due to the new cross-disciplinary, outcome-focused and programmatic approach being applied across the rest of UKRI’s portfolio. However, research councils will continue to play a crucial role in the governance, policy formulation, investment decisions and delivery across the rest of the portfolio.

UKRI will manage its budgets dynamically over the SR period to respond to and capture emerging opportunities. This means that budgets set out here should be treated as a guide and may not reconcile directly with future outturn at the end of each financial year.

UKRI will set out further detail on its corporate strategy to deliver its new mission, as well as more detailed delivery plans to deliver prioritised outcomes, in a further set of strategic documents to be published in spring 2026.

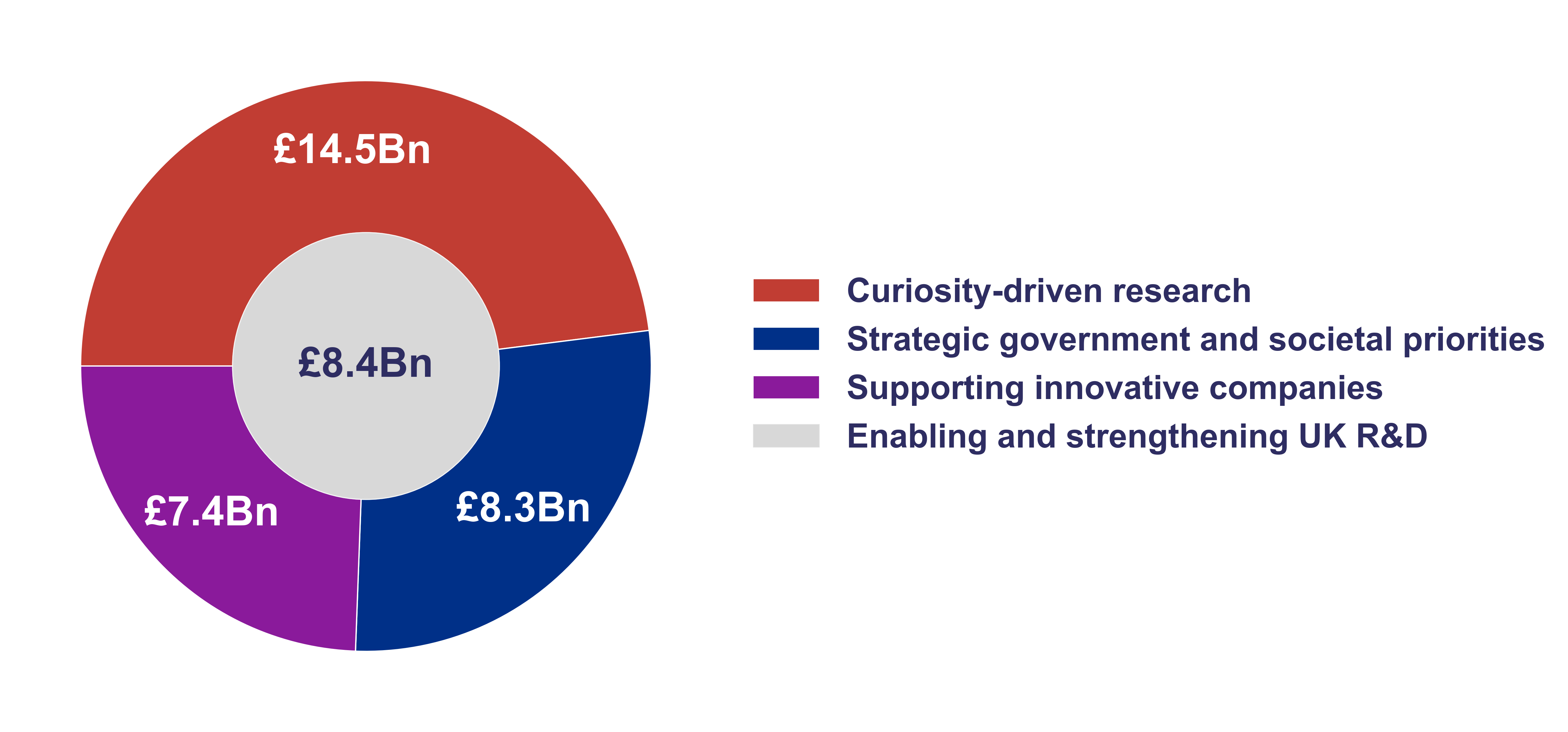

Investment in three priority buckets

Over the spending review period, UKRI plans to invest:

- £14.5 billion for curiosity-driven, foundational research, which underpins the UK’s long-term R&D leadership (Table 3)

- £8.3 billion for targeted R&D addressing strategic government and societal priorities, which will have clear objectives, measurable impacts, and an ambition to secure an average three to one leverage ratio (Table 5)

- £7.4 billion to support innovative companies’ growth, helping firms to start, scale and remain in the UK, aligned with wider government levers including regulation, procurement, trade and skills (Table 7)

£8.4 billion will be invested to strengthen UK R&D (Table 9) enabling essential capabilities needed across the three R&D priority buckets, including talent, infrastructure, institutes and facilities. It will also invest in transformation to align UKRI’s operation to DSIT’s new more agile model for managing R&D, strengthening accountability, leadership, governance and organisational effectiveness.

Over the SR period, UKRI will continue work to increase the coherence of its portfolio within and across buckets. As set out in this explainer’s ‘curiosity-driven research’ section, this means that some elements of funding will move from that bucket to others from 2027 to 2028 [1 – footnotes], while continuing to support their respective outcomes and recipients.

Table 1: UKRI budgets by R&D buckets

| R&D bucket | 2026 to 2027 | 2027 to 2028 | 2028 to 2029 | 2029 to 2030 | Total |

|---|---|---|---|---|---|

| 1. Curiosity-driven research | 3,653 | 3,581 | 3,612 | 3,638 | 14,484 |

| 2. Strategic government and societal priorities | 1,924 | 2,100 | 2,119 | 2,176 | 8,320 |

| 3. Supporting innovative companies | 1,638 | 1,845 | 1,938 | 1,945 | 7,366 |

| 4. Enabling and strengthening UK R&D | 2,004 | 2,063 | 2,122 | 2,227 | 8,416 |

| Total | 9,220 | 9,589 | 9,791 | 9,986 | 38,586 |

‘Enabling and strengthening UK R&D’: Investments sit within the ‘enabling and strengthening UK R&D’ bucket where they make substantial contributions across multiple priorities. This includes, for example, investments in underpinning talent and skills and multidisciplinary facilities.

Figure 1: Total investment in R&D buckets over the spending review period

Figure 1: Total investment in R&D buckets over the spending review period

Download the data for Table 1 and Figure 1 (ODS, 5KB).

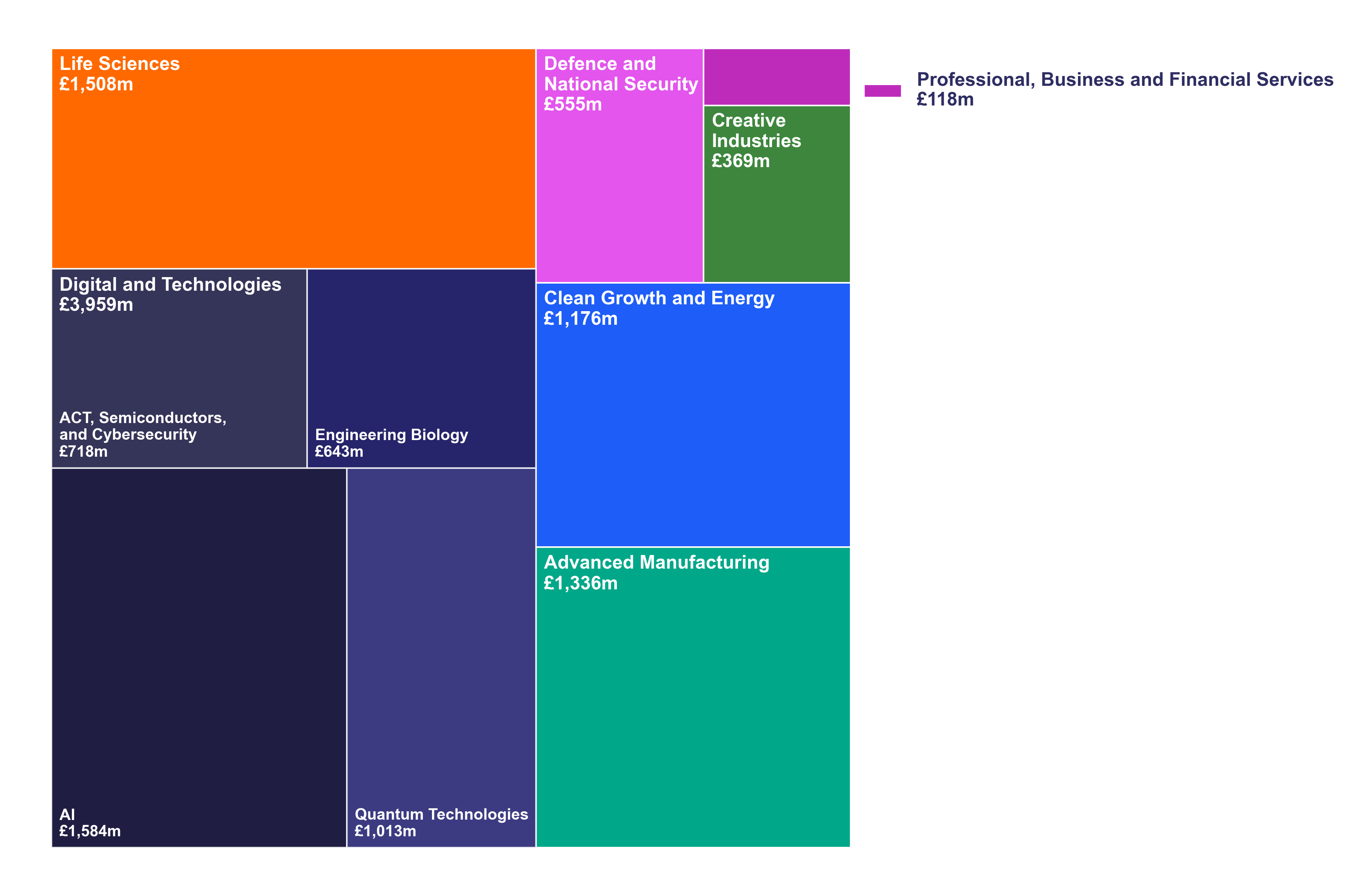

Support for Industrial Strategy growth sectors and wider government priorities

UKRI is establishing programmes across buckets two and three (‘strategic government and societal priorities’ and ‘supporting innovative companies’), each led by an executive chair Senior Responsible Owner (SRO), to deliver research and innovation aligned to government priorities and economic opportunities and enable a unified point of contact for stakeholders. A major focus of these cross-UKRI programmes are the eight Modern Industrial Strategy high-growth sectors. Over the SR period, the proportion of investment in these buckets directed at the Industrial Strategy sectors will increase, while continuing investment into wider government priorities for the benefit of the UK public.

Programmes will be developed with DSIT and other government departments, universities, researchers, innovators, investors and businesses, and will use the full capabilities of UKRI’s councils and enabling functions. Investment across all of UKRI’s priorities, from curiosity to targeted research, innovative company support to strengthening infrastructure and skills, will drive the outcomes for each sector.

UKRI will work closely with industrial and financial partners, including the British Business Bank, to enable joined-up investment plans. At portfolio level, investments will target an average leverage ratio of at least £3 of private investment for every £1 of public investment, with higher ratios when investing to support innovative companies, supporting increasing long-term benefits to society. Investments in one sector or technology will have applications across sectors. For example, quantum technology investment will have applications for defence, and defence investment will have applications for advanced manufacturing. Strengthening these synergies across UKRI will drive growth now and in the future, and provide best value for UK taxpayers.

Table 2 includes:

- targeted research and innovation grants

- focused activity through institutes and infrastructures

- significant specific investment in critical technologies, per the ‘Digital and Technologies’ funding lines (these include funding for activity that UKRI will deliver on behalf of DSIT, with values subject to change as delivery plans are finalised)

Beyond this activity, additional investment across UKRI will further support these sectors as set out in tables 5 to 8, such as:

- the new Local Innovation Partnerships Fund

- R&D Missions Accelerator Programme

- large-scale compute investment

Table 2: Targeted investment in Industrial Strategy growth sectors across priority buckets

| Sector | Strategic government and societal priorities (SR total in millions) |

Supporting innovative companies (SR total in millions) |

Combined investment (SR total in millions) |

|---|---|---|---|

| Advanced Manufacturing | 353 | 983 | 1,336 |

| Clean Growth and Energy | 377 | 799 | 1,176 |

| Creative Industries | 269 | 100 | 369 |

| Defence and National Security | 391 | 164 | 555 |

| Digital and Technologies: Engineering Biology | 235 | 408 | 643 |

| Digital and Technologies: AI | 1,133 | 452 | 1,584 |

| Digital and Technologies: Quantum Technologies | 426 | 588 | 1,013 |

| Digital and Technologies: Advanced Connectivity Technologies (ACT), Semiconductors, and Cybersecurity | 202 | 516 | 718 |

| Life Sciences | 1,080 | 428 | 1,508 |

| Professional, Business and Financial Services | 54 | 64 | 118 |

| Wider priorities | 2,308 | 636 | 2,944 |

‘Advanced Manufacturing’ includes agritech. Further details will be set out in due course.

‘Wider priorities’ funding in the ‘strategic government and societal priorities’ bucket will remain open to emerging priorities, and also include:

- climate adaptation, environment and resilience

- space

- food, animal and plant health

‘Wider priorities’ funding in the ‘supporting innovative companies’ bucket will cover Innovate UK’s wider business support activities, with further detail to follow in due course.

Figure 2: Total allocation by IS sector over the spending review period

Figure 2: Total allocation by IS sector over the spending review period

Note that throughout this document rounding has been applied and therefore some totals will not sum from the subtotals.

Download the data for Table 2 and Figure 2 (ODS, 7KB).

Curiosity-driven research

Curiosity-driven research underpins the UK’s R&D strength. Our knowledge ecosystem is a source of UK comparative advantage globally and drives transformative impacts and value as yet unknown, creating the foundation for long-term economic growth. UKRI will sustain and expand on this strength by investing:

- £3.3 billion into applicant-led research [2 – footnotes] allocated to research councils for broad disciplinary and interdisciplinary health and to support curiosity-driven discovery [3 – footnotes]

- £8.9 billion into quality-related (QR) research funding to universities in England [4 – footnotes] with UKRI investment in core QR [footnote 5] and Higher Education Innovation Funding (HEIF) growing in line with expected inflation over the spending review period (noting that formula-based HEIF funding is delivered through the ‘supporting innovative companies’ bucket)

- £2.3 billion into other investments essential for thriving curiosity-driven research, including institutes and infrastructures directly supporting transformative discoveries, open access and metascience (with investment trebled)

Across all buckets, overall investment available to universities across block grants and competitive calls will increase across the SR period. Funding will be delivered by research councils in other buckets, meaning that total funding for disciplines will be greater than set out in Table 4.

Changes to how UKRI invests and prioritises will mean some changes to how UKRI invests in English higher education providers. This is to align to the vision set out in the government’s post-sixteen education and skills white paper. The changes will take place from the financial year 2027 to 2028.

As part of this, some specific, non-recurrent Research England funds (worth around 3% of total QR funding) will be phased out. Universities will continue to benefit from the previous level of investment through an increase in applicant-led grants in bucket one. They will also benefit from other new and increasing programmes in funding lines in other buckets. In addition, responsibility for some investments currently in this bucket will be transferred to other priority buckets to support effective alignment and coherence across UKRI’s portfolio, while continuing to support universities. For example, a small amount of HEIF funding is currently funded out of QR, and this funding will be moved to the ‘supporting innovative companies’ bucket from 2027 to 2028 to sit alongside the wider HEIF programme.

These changes being made by UKRI to increase the coherence of its portfolio therefore mean that the ‘quality-related research funding’ line in Table 3 reduces in 2027 to 2028, but overall levels of funding available to universities will continue to increase in aggregate. UKRI investment in core QR [5 – footnotes] and HEIF will grow in line with expected inflation over the spending review period; a cumulative increase of around £425 million. Further information will be communicated in the coming months, including academic year impacts.

Table 3: Investment in curiosity-driven research

| Curiosity-driven research | FY 2026 to 2027 (total in millions) | FY 2027 to 2028 (total in millions) | FY 2028 to 2029 (total in millions) | FY 2029 to 2030 (total in millions) | Total (in millions) |

|---|---|---|---|---|---|

| Applicant-led research | 815 | 821 | 836 | 866 | 3,338 |

| Quality-related research funding | 2,258 | 2,161 | 2,197 | 2,234 | 8,850 |

| Other investments | 580 | 599 | 579 | 538 | 2,296 |

| Total | 3,653 | 3,581 | 3,612 | 3,638 | 14,484 |

‘Other investments’: these are investments essential for thriving curiosity-driven research, including institutes, international subscriptions and infrastructures directly supporting transformative discoveries, open access and metascience.

Download the data for Table 3 (ODS, 5KB).

Table 4: Investment in curiosity-driven research: breakdown of applicant-led research

| Curiosity-driven research: breakdown of applicant-led research | FY 2026 to 2027 (total in millions) | FY 2027 to 2028 (total in millions) | FY 2028 to 2029 (total in millions) | FY 2029 to 2030 (total in millions) | Total (in millions) |

|---|---|---|---|---|---|

| Arts and Humanities Research Council | 39 | 42 | 42 | 45 | 167 |

| Biotechnology and Biological Sciences Research Council | 112 | 113 | 111 | 117 | 454 |

| Engineering and Physical Sciences Research Council | 292 | 294 | 288 | 295 | 1,170 |

| Economic and Social Research Council | 66 | 71 | 71 | 73 | 281 |

| Medical Research Council | 113 | 113 | 111 | 115 | 453 |

| Natural Environment Research Council | 84 | 86 | 85 | 88 | 342 |

| Science and Technology Facilities Council | 83 | 86 | 86 | 90 | 344 |

| Outcome-driven allocation | 42 | 43 | 85 | ||

| Cross-research council responsive mode pilot | 26 | 16 | 42 | ||

| Total | 815 | 821 | 836 | 866 | 3,338 |

‘Outcome-driven allocation’: this represents budget not yet assigned to research councils to enable UKRI to respond to emerging priorities.

‘Cross-research council responsive mode pilot’: UKRI’s pilot has supported a strong programme of interdisciplinary research over its two rounds, and developed methods for its effective assessment and monitoring. To build on this success, UKRI is meeting the commitments from the pilot and integrating the learning from this approach across its research grant programmes after the pilot’s conclusion.

Download the data for Table 4 (ODS, 5KB).

Strategic government and societal priorities

UKRI is delivering £8.3 billion of targeted R&D investment to support strategic government and societal priorities, including:

- £6.8 billion of programmatic support for Industrial Strategy sectors and wider government priorities delivered by cross-UKRI programmes, each with one SRO

- £500 million for the flagship R&D Missions Accelerator Programme

- £750 million to fund the large-scale national supercomputing service at Edinburgh

Over £240 million of other investments in infrastructure, institutes, and talent directly delivering government priorities.

Further detail on UKRI’s SRO-led programmes will be published in 2026, with prioritisation within programmes informed by stakeholders including government, industry and the UK’s R&I communities. The majority of this investment will be delivered by research councils, complementing curiosity-driven research budgets.

Table 5: Investment in strategic government and societal priorities

| Strategic government and societal priorities | FY 2026 to 2027 (total in millions) | FY 2027 to 2028 (total in millions) | FY 2028 to 2029 (total in millions) | FY 2029 to 2030 (total in millions) | Total (in millions) |

|---|---|---|---|---|---|

| Industrial Strategy sectors | 935 | 1,111 | 1,215 | 1,258 | 4,519 |

| Wider priorities | 651 | 571 | 576 | 510 | 2,308 |

| R&D Missions Accelerator Programme | 50 | 120 | 130 | 200 | 500 |

| Large-scale compute | 240 | 240 | 135 | 135 | 750 |

| Other investments | 49 | 59 | 63 | 73 | 243 |

| Total | 1,924 | 2,100 | 2,119 | 2,176 | 8,320 |

‘Other investments’: Investments in infrastructure, institutes and talent directly delivering on government priorities.

‘Wider priorities’ funding in the ‘strategic government and societal priorities’ bucket will remain open to emerging priorities, and also include:

- climate adaptation, environment and resilience

- space

- food, animal and plant health

Download the data for Table 5 (ODS, 5KB).

Table 6: Strategic government and societal priorities: breakdown of Industrial Strategy sectors

| Strategic government and societal priorities: breakdown of Industrial Strategy sectors | FY 2026 to 2027 (total in millions) | FY 2027 to 2028 (total in millions) | FY 2028 to 2029 (total in millions) | FY 2029 to 2030 (total in millions) | Total (in millions) |

|---|---|---|---|---|---|

| Advanced Manufacturing | 82 | 85 | 95 | 92 | 353 |

| Clean Growth and Energy | 82 | 86 | 104 | 106 | 377 |

| Creative Industries | 50 | 67 | 58 | 95 | 269 |

| Defence and National Security | 106 | 93 | 95 | 97 | 391 |

| Digital and Technologies: Engineering Biology | 45 | 78 | 62 | 50 | 235 |

| Digital and Technologies: AI | 143 | 254 | 340 | 397 | 1,133 |

| Digital and Technologies: Quantum Technologies | 84 | 98 | 126 | 118 | 426 |

| Digital and Technologies: ACT, Semiconductors, and Cybersecurity | 47 | 46 | 55 | 54 | 202 |

| Life Sciences | 286 | 292 | 267 | 234 | 1,080 |

| Professional, Business and Financial Services | 10 | 12 | 15 | 17 | 54 |

| Total | 935 | 1,111 | 1,215 | 1,258 | 4,519 |

Download the data for Table 6 (ODS, 5KB).

Supporting innovative companies

UKRI will invest £7.4 billion of targeted investment to support innovative companies. This will include:

- £5.1 billion in Industrial Strategy sectors and wider government priorities as part of cross-UKRI SRO-led programmes (Table 2). This includes the Catapult Network, reflecting the increasing alignment and importance of the portfolio to these objectives.

- £1.8 billion in knowledge exchange, translation and commercialisation activities, including through HEIF and council-led programmes, as well as cross-UKRI proof-of-concept funding and additional targeted investment

- £410 million in this SR period through the Local Innovation Partnership Fund [6 – footnotes] which will support innovation leadership across the whole of the UK

Table 7: Investment in supporting innovative companies

| Supporting innovative companies | FY 2026 to 2027 (total in millions) | FY 2027 to 2028 (total in millions) | FY 2028 to 2029 (total in millions) | FY 2029 to 2030 (total in millions) | Total (in millions) |

|---|---|---|---|---|---|

| Industrial Strategy sectors | 979 | 1,141 | 1,183 | 1,197 | 4,502 |

| Wider priorities | 159 | 159 | 159 | 159 | 636 |

| Local Innovation Partnership Fund | 90 | 90 | 130 | 130 | 440 |

| Knowledge exchange, translation & commercialisation | 410 | 454 | 465 | 458 | 1,788 |

| Total | 1,638 | 1,845 | 1,938 | 1,945 | 7,366 |

‘Wider priorities’ in this bucket will cover Innovate UK’s wider business support activities, with further detail to follow in due course.

‘Local Innovation Partnership Fund’: this budget also includes £30 million for remaining Strength in Places Fund commitments.

Download the data for Table 7 (ODS, 5KB).

Table 8: Supporting innovative companies: breakdown of Industrial Strategy sectors

| Supporting innovative companies: breakdown of Industrial Strategy sectors | FY 2026 to 2027 (total in millions) | FY 2027 to 2028 (total in millions) | FY 2028 to 2029 (total in millions) | FY 2029 to 2030 (total in millions) | Total (in millions) |

|---|---|---|---|---|---|

| Advanced Manufacturing | 236 | 244 | 252 | 251 | 983 |

| Clean Growth and Energy | 212 | 209 | 189 | 189 | 799 |

| Creative Industries | 25 | 25 | 25 | 25 | 100 |

| Defence and National Security | 41 | 41 | 41 | 41 | 164 |

| Digital and Technologies: Engineering Biology | 57 | 107 | 124 | 120 | 408 |

| Digital and Technologies: AI | 101 | 109 | 115 | 127 | 452 |

| Digital and Technologies: Quantum Technologies | 85 | 151 | 171 | 180 | 588 |

| Digital and Technologies: ACT, Semiconductors, and Cybersecurity | 99 | 132 | 144 | 141 | 516 |

| Life Sciences | 107 | 107 | 107 | 107 | 428 |

| Professional, Business and Financial Services | 16 | 16 | 16 | 16 | 64 |

| Total | 979 | 1,141 | 1,183 | 1,197 | 4,502 |

Download the data for Table 8 (ODS, 5KB).

Enabling and strengthening UK R&D

UKRI will direct £8.4 billion to enabling and strengthening the UK’s R&I ecosystem through investments that support multiple priority outcomes in buckets one to three. Additional investment in institutes, collective talent, infrastructure and international activity will support outcomes exclusively in bucket one, bucket two or bucket three. Where this is the case, their funding is included as part of total investment in that bucket. As a result, UKRI’s total investment in each activity type will be higher than those given in Table 9.

UKRI has prioritised transformative investment in digital research infrastructure, complementing DSIT’s £1 billion commitment in its UK Compute Roadmap to expand the UK’s compute capacity twenty-fold in the next five years.

As a result, UKRI will be making important changes to its infrastructure portfolio to support infrastructure in a more effective and transparent manner. This includes through the Research Capital Investment Fund (RCIF), competitive capital calls through research council world class labs (WCL) and focused infrastructure investment into institutes.

After tapering in financial year 2026 to 2027, investment in RCIF will be reformed from financial year 2027 to 2028 with its use focused on sustaining current facilities. Funding will then be made available for new equipment through competitive capital calls by combining resources to form a more coherent and transparent infrastructure funding approach.

Through this, both higher education providers and research institutes across the UK will continue to have the opportunity to apply via both competitive equipment and collaborative facilities calls. This will maximise delivery of agreed outcomes, including strategic prioritisation, and support the sector towards greater specialisation and collaboration. Further details will be communicated in 2026.

Table 9: Investment in enabling and strengthening UK R&D

| 2026 to 2027 | 2027 to 2028 | 2028 to 2029 | 2029 to 2030 | Total | |

|---|---|---|---|---|---|

| Institutes | 402 | 406 | 423 | 399 | 1,630 |

| Collective Talent | 806 | 851 | 903 | 907 | 3,467 |

| Infrastructure | 486 | 502 | 485 | 596 | 2,069 |

| International subscriptions and partnerships | 130 | 124 | 132 | 124 | 510 |

| Other investments | 180 | 180 | 180 | 200 | 740 |

| Total | 2,004 | 2,063 | 2,122 | 2,227 | 8,416 |

‘Other investments’ includes administrative support and investment in the transformation of UKRI’s systems and processes.

Download the data for Table 9 (ODS, 5KB).

Footnotes

The footnotes are:

[1] This explains the reduction in the ‘curiosity-driven research’ bucket between the financial years 2026 to 2027 and 2027 to 2028.

[2] This forms one arm of UKRI’s total research grant investment of over £6.3 billion over the spending review period, with the remaining being part of cross-UKRI programmes delivering on government priorities.

[3] This complements the roles research councils will also play in delivering funding allocated to programmes in buckets two, three and four.

[4] This maintains the balance of dual support at around 64p for every £1 invested through eligible activities between financial years 2026 to 2027 and 2029 to 2030.

[5] Mainstream QR (including London weighting), QR research degree programme supervision fund, QR charity support fund, QR business research element, QR funding for national research libraries.

[6] Local Innovation Partnerships Fund investment forms part of a £500 million total lifetime commitment.