Foreword

I am pleased to present the UK Research and Innovation (UKRI) counter fraud, bribery and corruption strategy. UKRI holds itself to the highest standards of integrity and accountability. Our commitment to fostering a culture of transparency and ethical conduct is unwavering.

The counter fraud, bribery, and corruption strategy is a testament to our proactive stance in protecting public funds. It will enable us to maintain the trust placed in us to deliver research and innovation to the heart of UK society and manage the economic challenges we face.

This strategy outlines our comprehensive approach to preventing, deterring, detecting, and responding to fraud, bribery, and corruption, ensuring that our organisation remains properly protected.

In an increasingly complex and interconnected world, the risks associated with fraud and corruption are ever evolving. It is imperative that we remain vigilant and adaptive, continuously enhancing our measures to address these challenges. This strategy sets out our approach and priorities. It specifically emphasises the importance of fostering a counter fraud culture and one where ethical standards are high. By empowering our staff with the knowledge and tools to identify and report fraud or corruption, we reinforce our collective responsibility to uphold the integrity of our organisation.

I am confident that this strategy will serve as a robust framework for protecting our resources and reputation. It is a call to action for all members of UKRI and our stakeholders that we are steadfast in our commitment to protecting public funds and managing fraud risks. Together, we can ensure that UKRI continues to be a beacon of excellence and integrity in research and innovation. I encourage everyone to familiarise themselves with this strategy and to actively contribute to its successful implementation.

Siobhan Peters, Chief Financial Officer, UKRI

Our mission

At UKRI our mission is to convene, catalyse and invest in close collaboration with others to build a thriving, inclusive research and innovation system that connects discovery to prosperity and public good.

This counter fraud, bribery and corruption strategy aligns with UKRI’s overarching objectives of driving transformative research, fostering innovation, contributing to economic growth, and addressing societal challenges. By safeguarding our resources from fraud, we ensure that taxpayer’s money is used effectively to achieve these goals. Our commitment to integrity and transparency underpins our efforts to create a robust defence against fraud, bribery and corruption, thereby enhancing public trust and confidence in our organisation.

Background

Fraud remains a significant challenge for public sector organisations, with evolving tactics and increasing sophistication. According to recent data produced by the Office for National Statistics, fraud is the most common crime in the UK. It accounts for an estimated 41% of all reported crimes, with cyber-enabled fraud and international fraud networks posing major threats.

The Crime Survey for England and Wales estimates that 4.1 million fraud offences occurred in the year ending December 2024. This represents a 33% increase in offences from the previous year. Over 70% of all fraud offences in the UK have ties to overseas criminals, and over 80% are cyber-enabled, highlighting the need for robust international cooperation and advanced technological solutions.

Fraud in the public sector was estimated to be between £39.8 billion and £58.5 billion in the 2024 to 2025 financial year, according to the Public Sector Fraud Authority (PSFA).

Fraud not only results in financial losses but also undermines public trust and diverts resources away from vital services. Fraud affects all sectors and can lead to significant reputational damage, legal consequences, and operational disruptions. By addressing fraud effectively, we can enhance the integrity of our operations and ensure that funds are directed towards achieving our strategic objectives. The impact of fraud and corruption extends beyond financial losses, affecting employee morale, public confidence, and the overall effectiveness of public services.

The PSFA was established in August 2022 and has been instrumental in preventing and recovering significant amounts of taxpayer money, achieving £311 million in savings in its first 12 months. Significant challenges, however, lie ahead in tackling fraud.

UKRI must be ready to counter the evolving threat of fraud, which includes the rising prevalence of corporate impersonation and mandate fraud. In these schemes, scammers pose as legitimate recipients of funds, making it crucial for UKRI to stay vigilant and proactive in our defence strategies.

Advanced technologies such as artificial intelligence (AI) and machine learning have been utilised by fraudsters to bypass security measures. Deepfake videos and voices produced by AI can make it challenging to distinguish between genuine and fraudulent communication. Cyber enabled criminality targeting vulnerabilities in financial systems are providing more opportunities for fraudulent attempts against the public sector.

Key themes in this strategy include:

- raising awareness of fraud, bribery and corruption risks with UKRI staff

- increasing our use of technology to enable improved analysis of fraud and investigation data

- prevention of fraud, bribery and corruption

- ensuring UKRI is a prominent member of counter fraud networks across government

Scope

This document outlines UKRI’s strategic approach to addressing fraud, bribery, and corruption. Our commitment is to prevent, deter, detect, and respond to it, ensuring we protect our budget and maximise the benefits UKRI brings through research and innovation. An important aim in this strategy is to improve our alignment with the Cabinet Office Counter Fraud Functional Standards (GovS 013) and increase resilience to the fraud risks that the organisation faces.

The National Audit Office (NAO) and the Government Internal Audit Agency (GIAA) have previously raised concerns about UKRI not achieving full compliance with government standards for counter fraud.

UKRI identified the governance and management of counter fraud as a principal risk in 2023 and reorganisation, recruitment and delivery of a new operating model has taken place to mitigate this risk.

The UKRI Risk, Assurance and Counter Fraud and Investigations Directorate provides proactive and reactive counter fraud capability. This includes a small team of experienced investigators that operate under the broad powers of the Higher Education and Research Act 2017. The team have not been granted any specific law enforcement or legal powers to compel the provision of evidence or other material from witnesses or suspects to support investigations.

Collaboration and establishing good networks with the police, other law enforcement agencies and regulators is key to the success of investigation efforts where legal and enforcement powers are required. Where tackling identified fraud is not possible through sanctions or prosecutions, disrupting it with the support of others, should always be a consideration.

To manage the peaks of case referral demand, certain UKRI investigations are required to be outsourced to appropriate investigation service providers.

Through collaboration with colleagues within UKRI, Department for Science, Innovation and Technology (DSIT), and experts from the PSFA, the National Economic Crime Centre, and law enforcement agencies, we aim to address serious cases in the most appropriate way. This includes criminal or civil sanctions, regulatory actions, and recovery processes to secure lost assets.

The Public Authorities (Fraud, Error and Recovery) Bill is at committee stage in the House of Lords as of June 2025. The Bill makes provision about the prevention of fraud against public authorities and the making of erroneous payments by public authorities. It includes the recovery of money paid by public authorities because of fraud or error and for connected purposes. Clarity on the likely enforcement powers and the size, scope and role of the PSFA, proposed in this legislation, is yet to be finalised.

Our collaboration priorities extend to forming professional, cross government investigation and counter fraud networks, conducting horizon scanning, so that the wider fraud landscape is understood.

The scope of this strategy and UKRI counter fraud investigations is intended to manage all referrals relating to the grants that UKRI awards and any internal fraud or bribery allegations. It does not extend to cases where grants and funding provided, managed properly and within controls by the recipients, has then been subject of fraud, committed by a third party. These matters remain the responsibility of the police and should be reported directly.

This strategy is supported by an action plan (see Annex A) detailing both operational and policy activities.

Objectives

The primary objectives of this counter fraud strategy are as follows.

Prevent

Strengthen preventive measures to protect UKRI funds and maintain the integrity of our operations. This involves:

- implementing a robust counter fraud, bribery and corruption policy and response plan

- providing comprehensive training to staff

- promoting awareness of fraud risks and lessons learned

The responsibility of staff identifying fraud as a first line of defence when managing financial transactions, implementing controls and mitigating risks is vital.

Deter

Implement measures to minimise the occurrence of fraud within UKRI. This includes:

- strengthening internal controls

- conducting a regular review of thematic Fraud Risk Assessments (FRAs)

- fostering a culture of integrity and accountability

UKRI’s whistleblowing policy and approach to treating the ‘Freedom to speak up’ seriously is a positive act, which can make a valuable contribution to UKRI’s counter fraud, bribery and corruption effort and long-term success. Taking timely and effective recovery action, publicising successful prosecutions and financial recovery, can assist in deterring economic crime.

Detect

Improve the identification and detection of fraudulent activities through:

- advanced data analytics

- collaboration

- data sharing with external partners

- use of innovative technologies

By enhancing our detection capabilities, we aim to identify and address fraud at an early stage, minimising its impact on UKRI and the people and organisations we support.

Respond

Improve the approach to managing allegations of fraud, corruption and bribery so that timely investigation and proportionate action can be taken. We will prioritise actions that will stop fraudulent activity and support the recovery of funds. UKRI will refer cases to the Police where a criminal prosecution would be in the public interest.

Strategic approach

Principles and framework

This counter fraud strategy is guided by the five Principles for Public Sector Fraud and Corruption. These principles were developed by the International Public Sector Fraud Forum. This is a group of experts brought together from Five Eyes Countries, first established in 2017, of which the UK was a founding member. The aim of the forum is to share and develop best and leading practice in countering fraud.

The five principles are as follows.

There is always going to be fraud

Recognising that fraud will always exist and implementing robust processes to prevent, detect, and respond to it. This principle acknowledges the persistent nature of fraud and the need for continuous vigilance and adaptation.

Finding fraud is a good thing

Viewing the identification of fraud as a proactive achievement. If you do not find it, you cannot fight it. Detecting fraud is a positive outcome that enables us to take corrective action and prevent further losses.

There is no one solution

Addressing fraud through a comprehensive response involving detection, prevention, and redress. A holistic approach ensures that all aspects of fraud are considered, from identifying risks to implementing preventive measures and taking corrective action. This requires cooperation between delivery bodies and organisations in a spirit of collaboration.

Fraud and corruption are ever changing

Adapting to the quickly evolving nature of fraud and counter fraud practices. Fraud tactics are constantly changing, and our strategy must be flexible, and responsive to new threats, new technologies and vulnerabilities.

Prevention is the most effective way to address fraud and corruption

Emphasising prevention as the most effective way to address fraud and corruption. Preventive measures are crucial in reducing the likelihood of fraud occurring and minimising its impact.

Priorities

Priority 1: Counter fraud culture

This strategy focuses on key themes to influence, measure, improve and maintain a counter fraud culture. It is essential that UKRI adopts a proactive stance to counter fraud, customised to the specific risks within the organisation. This extends from those leading the organisation to all those associated with it.

Detecting and prosecuting fraud and corruption post-incident is significantly more challenging than preventing it from occurring in the first place. Opportunities to increase organisational efficiency by reducing fraud loss can be delivered through improved awareness and developing a counter fraud culture.

A counter fraud culture is defined as:

Consisting of ethical beliefs, behaviours, values and practices that fraud, bribery and corruption are not acceptable and effective action should be taken to detect and prevent wherever possible and proportionate. An effective culture is fostered through a cycle of education, measurement, monitoring and improvement.

Government Counter Fraud Profession Standards and Guidance, 2024, page 7.

A comprehensive preventive approach demands effort beyond the UKRI Risk, Assurance, Counter Fraud and Investigations Team. A key aim of this strategy is to build a network of counter fraud champions within UKRI corporate hub teams and councils. The counter fraud champions, must exert influence across various parts of the organisation to ensure a unified and effective strategy. A more developed governance structure to deliver counter fraud awareness, monitor data and share lessons learned is planned.

Our commitment is to deliver an improved communication strategy for counter fraud activity including well publicised success stories. There is often concern in an organisation that finding fraud damages reputation and indicates a failing. There is always going to be fraud, criminal methodologies are inventive and always evolving. All organisations are susceptible to fraud. Finding fraud and successfully addressing it should be celebrated as a success for the organisation.

Training and awareness

New starter training

All new UKRI employees undergo mandatory counter fraud, bribery, and corruption awareness training. This training covers the basics of fraud prevention, detection, and reporting, as well as UKRI’s policies and procedures.

Annual refresher courses

UKRI staff participate in annual mandatory training to stay updated on the latest fraud risks and prevention techniques. It is intended that these courses will be expanded to include case studies, interactive sessions, and updates on emerging fraud trends.

Specialist staff training

The delivery of additional Fraud Risk Assessment (FRA) training and staff attendance on the Fraud Loss Measurement Programme (FLMP) are objectives to deliver enhanced skills in specific areas of counter fraud work.

Awareness campaigns

Internal communications

Regular newsletters, key messages from counter fraud champions in our councils, and intranet updates to keep staff informed about fraud risks and prevention measures. These communications will highlight recent fraud cases, provide tips for preventing fraud, and remind staff of their responsibilities.

Workshops and seminars

We will organise workshops and seminars to engage staff and provide hands-on training on fraud detection and prevention. These events will feature guest speakers, interactive activities, and opportunities for staff to share their experiences and learn from each other.

Engagement activities

Fraud Awareness Week

This is an annual event to promote fraud awareness and encourage staff to actively participate in counter fraud activities. This event will include presentations, workshops (as above), and activities designed to raise awareness and promote a culture of vigilance.

Recognition programs

UKRI will acknowledge and reward employees who demonstrate exceptional vigilance and contribute to fraud prevention efforts. Recognition programs will include awards, certificates, and public acknowledegment of employees’ contributions.

We will measure this by:

- the number and percentage of UKRI staff who have completed annual counter fraud, bribery and corruption training

- number of specific team fraud awareness sessions and campaigns delivered

- total number of council funding or other process changes recommended by the Counter Fraud Investigation Service and undertaken in a year (for fraud and error identified)

- formal recognition of staff for vigilance and efforts to prevent fraud

- the results of the next self-assessment against the Government Functional Standard (GovS 013) due to take place in autumn 2025

- the number of UKRI thematic FRAs and Initial Fraud Impact Assessments (IFIA) completed and reviewed each year

- total value of fraud prevented in year

Priority 2: Detect fraud through, risk assurance, investigation, and collaboration

UKRI Risk Management teams support effective decision making through the systematic application of principles, approaches and processes to the tasks of identifying and assessing risks and then planning appropriate responses and implementing controls.

This includes management of supporting strategies and tools such as UKRI’s overall Risk Appetite for fraud and the Risk and Assurance Management System. This team operate in the same directorate as the Counter Fraud Investigation Service.

UKRI produces an Enterprise Fraud Risk Assessment, referencing and documenting thematic and specific fraud risks as a high-level fraud, bribery and corruption assessment of the main challenges facing the organisation. This is overseen by the UKRI Audit and Risk Assurance Committee (ARAC) and the Executive Committee (ExCo).

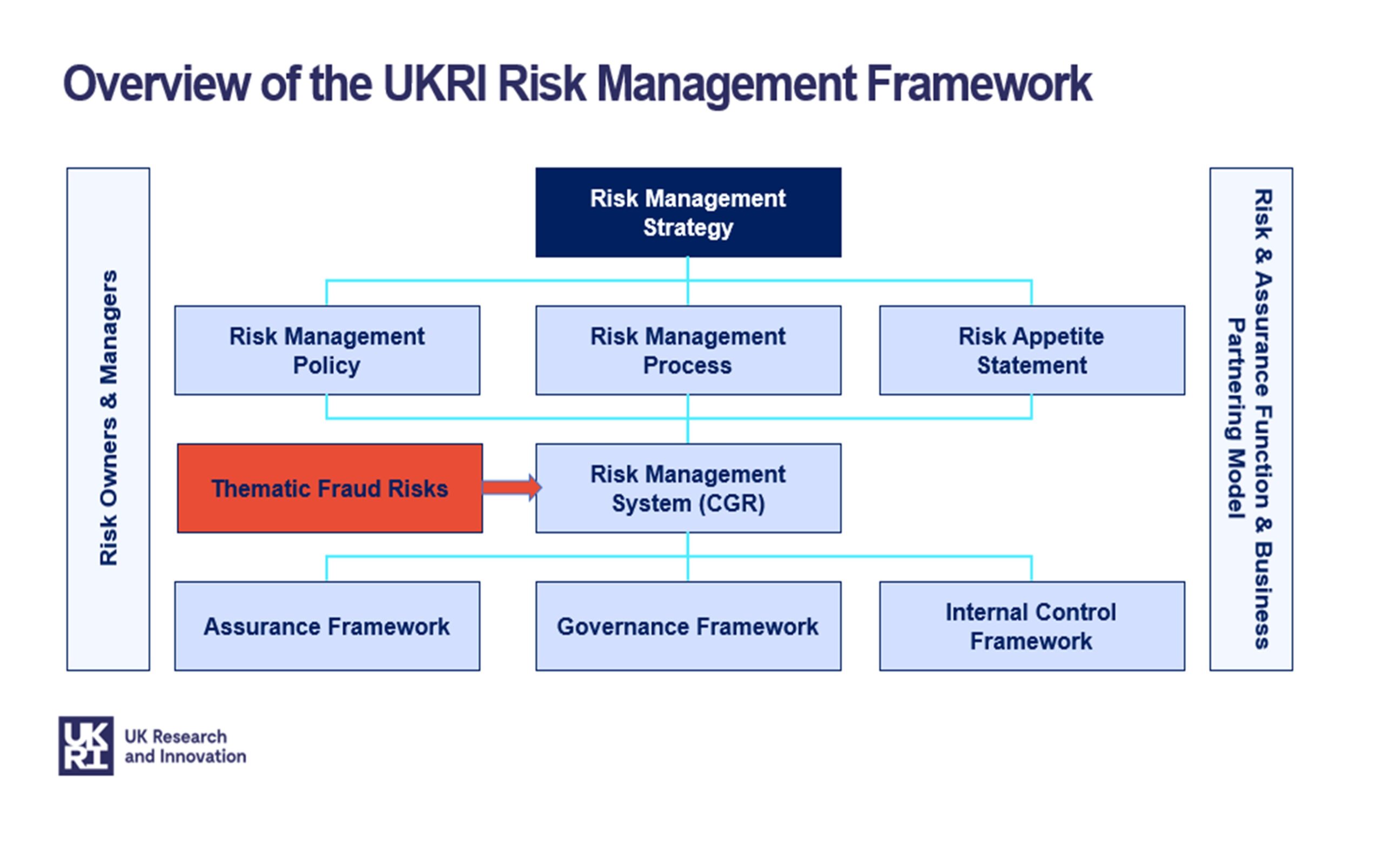

These thematic fraud risk assessments are regularly reviewed, through the People, Finance and Operations Committee and are applied to the significant volume of grant schemes, funding and internal matters where fraud, bribery and corruption are likely to exist. The position of fraud risk within the UKRI risk management framework is demonstrated in Appendix B.

The overall approach of managing fraud by the Risk Assurance, Counter Fraud and Investigation Directorate, brings together the necessary expertise required to fight it. It utilises the UKRI enterprise risk management system to clearly document the risks, issues, assurances and actions and deliver efficiencies across the organisation.

Staff training has commenced on the Fraud Risk Assessor programme to assist in the production of IFIA. This is a high-level fraud, bribery and corruption impact assessment that should be completed early in the life cycle of proposed new major UKRI spend activity.

Collaboration, innovation, and adaptability is required to effectively combat fraud. Collaboration involves counter fraud staff working with our internal and external partners in DSIT, the PSFA and law enforcement to share knowledge, identify enforcement opportunities, access specialist resources for help and to develop best practice. Innovation includes leveraging advanced technologies and data analytics to enhance our fraud detection and prevention capabilities. Adaptability ensures that our strategy remains relevant and effective in the face of evolving fraud threats.

We will measure this by:

- the number of annual fraud allegation referrals from internal and external sources

- the number of cases assessed, following referral and confirmed to be fraud, bribery or corruption

- average annual timeliness of cases to completion

- annual cases closed

- total fraud loss identified and recovered in year

- cross government counter fraud professional networks established to deliver horizon scanning and counter fraud training opportunities

Priority 3: Deter fraud through effective prevention, detection and recovery

UKRI operates a three-line control model in deterring and detecting fraud, from managing organisational control risks at the grant funding stage, through to risk management assurance and specific counter fraud team investigation, potentially resulting in the withdrawal of grant funding or legal interventions, where required.

Opportunities to discourage attempts to commit fraud, bribery and corruption will be taken. This will include taking effective recovery action and publicising successful claw back processes and outcomes to recoup funds.

The importance of seeking redress, where terms and conditions of UKRI grants have not been complied with, is vital to protect funds and reinforce the requirement for high ethical and accounting standards.

We will measure this by:

- total annual sanctions and formal referrals in year (for example grant or project termination, discipline, dismissal, police or regulatory referral)

- number and value of funding claw back or other recovery processes

- internal and external communications circulations on funding recovery success

Priority 4: Harness data, intelligence and analytics

UKRI aims to develop a data analytics standard within the counter fraud function.

The training objectives previously referenced, to deliver more FRA and FLMP skills, compliment this discipline in terms of counter fraud staff use of data to inform risk, develop and prioritise controls and improve the measurement of fraud loss.

An area to explore further is bulk data analytics which could be used to undertake counter fraud analysis. This is reliant on clear and legally robust data sharing agreements across government. It depends on the availability of bulk data sets and internal data analytic capability within UKRI or commissioned data.

An example of this is work in progress to deliver improved data sharing with HMRC that will provide intelligence led data to directly support investigations.

The PSFA have secured an element of funding to deliver improved results from data matching and analysis across government. This will be an avenue to explore in a UKRI data pilot exercise. The Single Network Analytics Platform, soon to be piloted with DSIT, is an example of efforts to improve data capture and produce accurate analysis of risk.

We will measure this by:

- staff training to develop skills to deliver a data analytics standard

- identifying methods to combine UKRI data from various sources (internal and external) to create a comprehensive dataset for analysis

- research undertaken to identify AI tools to detect patterns and anomalies indicative of fraud

- data and intelligence shared and received across departments and agencies to enhance collective fraud detection effort

- analysing and measuring fraud, bribery and corruption trend data to assist in fraud risk identification and proactive counter fraud initiatives

Priority 5: Combating bribery and corruption

UKRI employees are expected to comply with the highest standards of professional and ethical practice and are required to declare any interests which may conflict, or may be perceived to conflict, with UKRI’s business. UKRI maintains a policy and produces guidance for staff, setting out the responsibilities for employees and non UKRI employees, to declare interests and manage any potential conflicts of interest.

UKRI has a Gifts and hospitality policy which sets out how UKRI expects employees and those acting on behalf of UKRI, to conduct themselves when giving or receiving gifts and hospitality.

To manage the use of public money more effectively, the Cabinet Office have issued an instruction which covers all government departments and UKRI, to reduce the number of government procurement cards (GPCs) that are held by each department and to limit their use.

Updates regarding the use of GPCs were published for all UKRI staff in August 2025 and a thematic FRA has been documented to manage fraud risks.

UKRI maintains a whistleblowing policy and a team to manage whistleblowing referrals. This policy is essential for fostering transparency, accountability and a positive organisational culture. It offers employees a secure channel to report fraud, misconduct, or unethical behaviour. This delivers the protections for UKRI staff and other individuals, intended in the Public Interest Disclosure Act 1998.

We will measure this by:

- the number of whistleblowing cases that reference fraud, bribery and corruption

- analysis of directors of companies that receive grants and are also UKRI employees with conflict of interest register cross checks

- the number of specific audits of grant funding to identify and address any vulnerabilities in respect of bribery and corruption

- number of breaches of the Declarations of interest policy and the Gifts and hospitality policy

Monitoring

The UKRI Board has appointed the Chief Finance Officer as the accountable individual, who is responsible for supporting the UKRI Counter Fraud and Investigations Service and strategy as well as raising the profile of counter fraud activities across UKRI. The role includes:

- providing a senior strategic voice within UKRI to champion the counter fraud agenda and to support the full programme of counter fraud activities

- promoting and embedding awareness of fraud, bribery, and corruption across UKRI at a strategic level

- facilitating the progress and development of counter fraud activities and collaboration arrangements to investigate suspected offences

- driving a counter fraud culture across UKRI

The UKRI counter fraud function is inspected by the NAO and the GIAA. Recommendations from these inspections feed into the Action Plan for areas of focus and improvement.

UKRI provides quarterly Consolidated Data Returns to DSIT for onwards dissemination to the PSFA.

UKRI Audit Risk Assurance Committee (ARAC)

Overall reporting and monitoring of counter fraud performance is governed by UKRI ExCo Under the general principles of the UKRI delegations framework, ARAC review the adequacy of strategies and procedures relating to UKRI’s counter fraud activity to ensure that we take appropriate action to address the risk of fraud across the organisation. As part of this process, the Risk, Assurance, Counter Fraud and Investigations Team provide ARAC with regular progress reports and metric based Management Information against agreed objectives.

To support counter fraud activity, ARAC will monitor progress and implementation of this counter fraud strategy and the implementation of recommendations to address the risk of financial irregularity within UKRI’s activities.

People, Finance and Organisation Committee (PFO)

The PFO Committee is responsible for approval of policy. It receives regular reporting on counter fraud activities and seeks to provide challenge and to ensure ongoing compliance with the Government Counter Fraud Functional Standard GovS 013.

Fraud Risk Assessment (FRA) Working Group

The FRA Working Group is formed of representatives across UKRI to create, maintain and review thematic FRAs and deliver action plans for improvements. The FRAs are built into the UKRI enterprise risk management system, enabling reporting to live risk, assurance information and workflows to manage improvement actions

Government Functional Standard (GovS 13): Counter Fraud

UKRI complete an annual self-assessment against the Government Functional Standard for Counter Fraud. This is submitted to the PSFA and open to inspection by the GIAA.

Appendix A: UKRI counter fraud, bribery and corruption action plan 2025 to 2026

This annex aims to compile all the actions documented in the Strategic approach, Priorities and Monitoring sections. Measurement of all the below activity will be monitored through the UKRI ARAC Board and through regular engagement with DSIT and the PSFA.

Prevent

Area of UKRI Counter Fraud Strategy this action aligns to:

- embed a counter fraud culture in UKRI

- deliver training, counter fraud, bribery and corruption awareness campaigns and communications

- introduce new metrics to measure the impact of fraud prevention in UKRI

- document a new UKRI counter fraud, bribery and corruption policy 2025 to 2028

What will we do?

Monitor and report to the UKRI ExCo, ARAC Board, HR, Council and counter fraud champion leads, the number and percentage of UKRI staff who have completed annual counter fraud, bribery and corruption training.

Percentage of training completion. As the training is mandatory, adjusting for joiner and leaver impact and error the compliance should be in the 90 to 95% range. Trend data over three years.

Due date: April 2026

What we will do

Review the standard of UKRI counter fraud training to staff at all levels across the organisation. Identify any improvements that are required to deliver bespoke training needs dependant on fraud, bribery and corruption risk.

What will we measure?

Outcome of a qualitative and quantitative review of existing training.

Number of specific team training awareness sessions and fraud risk lessons learned disseminated.

Due date: July 2025

What will we do?

Review and update the UKRI counter fraud, bribery and corruption policy and Response plan.

What will we measure?

A document approved by the PFO, ARAC and ExCo of sufficient detail and quality, published for the benefit of UKRI staff and public consumption by the Web Team.

Due date: August 2025

What will we do?

Deliver specific recommendations on counter fraud controls and governance through counter fraud, bribery and corruption case reviews and organisational learning.

What will we measure?

Total value of fraud prevented in year.

Total number of council funding or other process changes recommended by the Counter Fraud Investigation Service

Due date: April 2026

Detect

Area of UKRI Counter Fraud Strategy this action aligns to:

- detect fraud through risk assurance, investigation and collaboration

- management of the Enterprise Fraud Risk Assessment to document main fraud risks

- record Thematic Fraud Risk Assessments and assist SROs in the delivery of IFIAs

- efficient and effective management of cases referred

- collaboration opportunities across government and law enforcement to develop best practice, share knowledge and identify enforcement opportunities

What will we do?

Complete Thematic UKRI Fraud Risk Assessments (FRA) (currently 18), reviewing these at regular intervals and documenting the key fraud risks.

Counter fraud professionals to assist and advise SROs on the completion of IFIAs for proposals of new major spend activity.

What will we measure?

Number of Thematic FRAs completed and updated at the FRA Working Group.

Number of UKRI IFIAs completed.

Due date: April 2026

What will we do?

Reduce the average timeliness of cases referred to CFIS and investigated to conclusion to below 12 months.

What will we measure?

Average timespan of cases completed over a 12-month period.

Due date: April 2026

What will we do?

Implement a priority case matrix to CFIS investigations at referral and triage to focus resources on cases of the highest risk, harm and threat.

What will we measure?

Implementation of this process by as a pilot for an initial six-month period. Monitor overall case volume and workload impact on the scoring process.

Case scoring consistency of application and processing time at triage will be a measure of efficiency.

Total fraud loss each year will be an associated metric.

Due date: January 2026

What will we do?

Improve UKRI professional counter fraud networks across government, law enforcement and with UK regulators to develop best practice and deliver counter fraud enforcement opportunities.

What will we measure?

The number of cross government counter fraud professional networks established to deliver horizon scanning and improved counter fraud training opportunities.

The number of cases referred to the police, a regulator or other government department.

Data sharing agreements and memorandum of understandings established.

Specialist counter fraud training sessions delivered.

Due date: April 2026

What will we do?

Deliver improvements to counter fraud trend data.

What will we measure?

Reports containing UKRI fraud, bribery and corruption trend data.

Establishing increases and decreases of thematic fraud loss and fraud risk over time.

Proactive work commissioned for risk, assurance and investigation teams.

Due date: September 2025

What will we do?

Research the availability of AI tools with His Majesty’s government or independent experts to apply to UKRI counter fraud data that meet an expert assessment standard of ‘highly likely’ to improve efficiencies, reduce loss and detect fraud.

What will we measure?

Time taken to identify appropriate AI tools.

Cost and resource time for assessment and acquiring counter fraud AI tools.

Impact on fraud, bribery and corruption case triage process in terms of time and accuracy.

Fraud prevented and detected.

Fraud case analysis capability and impact

Due date: April 2026

Deter

Area of UKRI Counter Fraud Strategy this action aligns to:

- deter fraud through effective prevention, detection and recovery

- combating bribery and corruption

- ensuring UKRI maintains high ethical standards in the management of public money,

- delivering grants and projects and following the UKRI code of conduct

- UKRI staff should act in accordance with the Delegation Framework 2024 and HM Treasury Managing Public Money 2023 guidance

What will we do?

Investigation of cases referred to a high professional standard.

Where proven delivering redress through withdrawal of grant funding or legal interventions as appropriate.

What will we measure?

Total annual sanctions and formal referrals in year (for example grant or project termination, discipline, dismissal, police or regulatory referral).

Fraud loss identified.

Due date: April 2026

What will we do?

Taking effective recovery action and publicising successful claw back processes and outcomes to recoup funds.

What will we measure?

Number and value of funding claw back or other recovery processes.

Internal and external communications on funding recovery success.

Due date: April 2026

What will we do?

Task UKRI Counter Fraud Investigators to conduct proactive investigation and analysis work in accordance with the National Fraud Initiative.

Using data matching from Companies House and other available data sets to identify potential corruption.

What will we measure?

Number of data sets compared from public and private sector organisations within the NFI.

Number of breaches of the Declarations of interest policy.

Due date: April 2026

What will we do?

Promote the UKRI whistleblowing policy and the protections of the Public Interest Disclosure Act (PIDA) 1998 to staff as a means of countering bribery and corruption

What will we measure?

The number of whistleblowing cases that reference fraud, bribery and corruption.

UKRI People Survey responses related to employee engagement and ethical standards.

Due date: April 2026

Appendix B

Overview of the UKRI risk management framework.

Appendix C

Further reading

Government Counter Fraud Functional Strategy 2024 to 2027